Gold Stocks: A Major Bottom May Be in Sight

The current macroeconomic backdrop should ultimately lead to a favorable outcome for precious metals, but, in the interim, it is putting pressure on that asset class.

Most notably, higher real interest rates and a strengthening greenback provide headwinds.

The timing of the transition to that favorable outcome is difficult to discern.

However, when focusing on gold stocks, we can use several indicators to pinpoint major lows and low-risk buying opportunities.

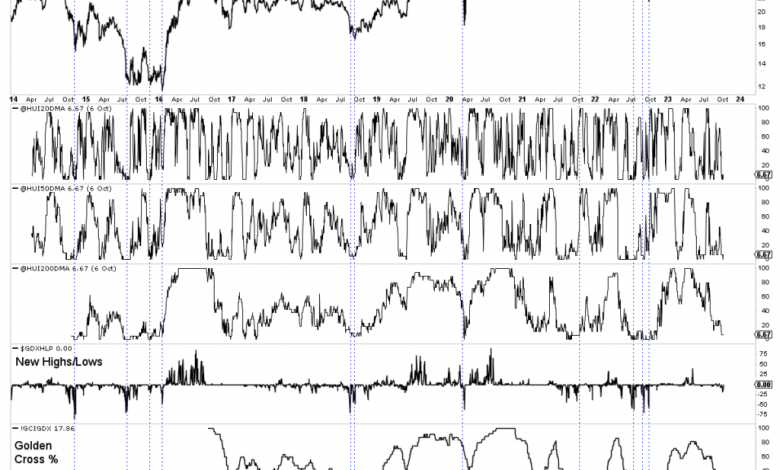

In the first chart, we plot GDX (NYSE:GDX) and six different breadth indicators. The first three show the percentage of miners (in the HUI index) that closed above the 20-day, 50-day, and 200-day moving averages.

The last three show the percentage of new highs or new lows in GDX, the percentage of GDX stocks in which the 50-day moving average is above the 200-day moving average (Golden Cross), and the percentage of GDX stocks on a point and figure chart buy signal.

The vertical lines mark those indicators’ extremes and the corresponding GDX lows. The gold stocks reached oversold extremes last week and are rebounding.

Moving forward, look for the Golden Cross percentage to hit 0% and a spike in new lows for a stronger signal of a major bottom. GDX-Daily Chart

GDX-Daily Chart

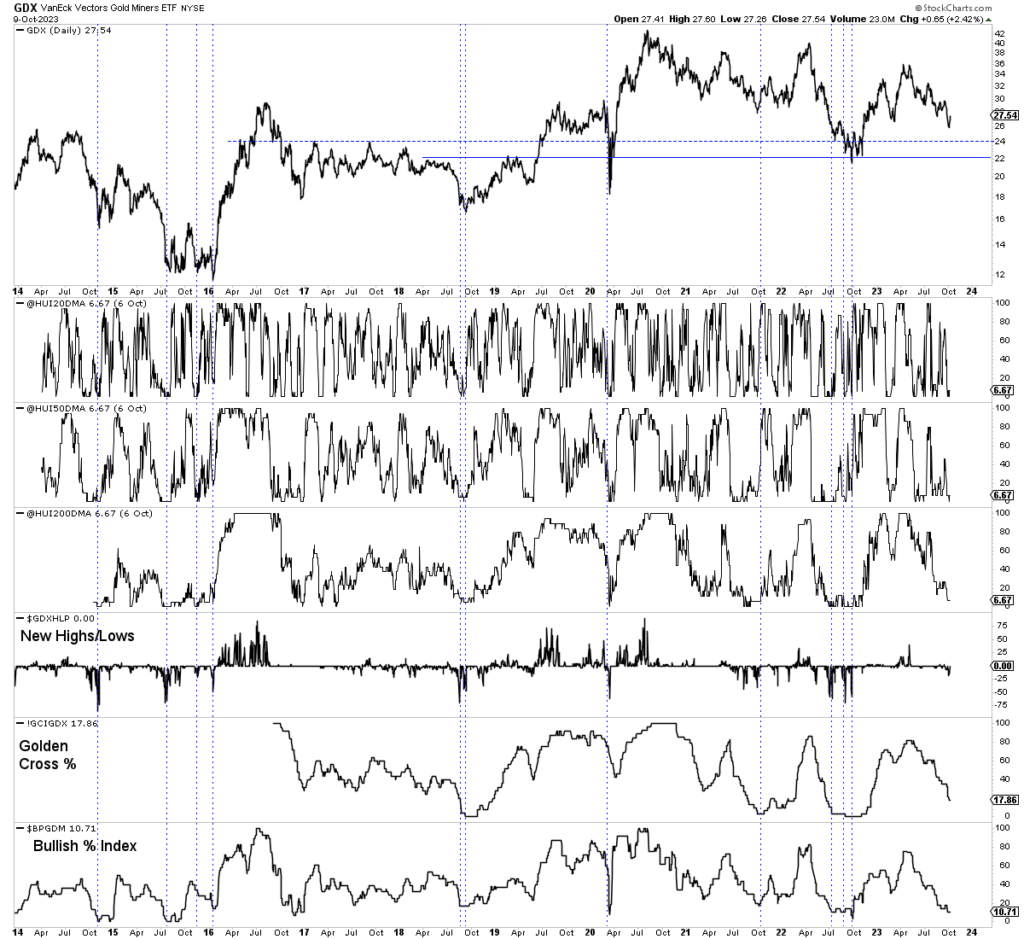

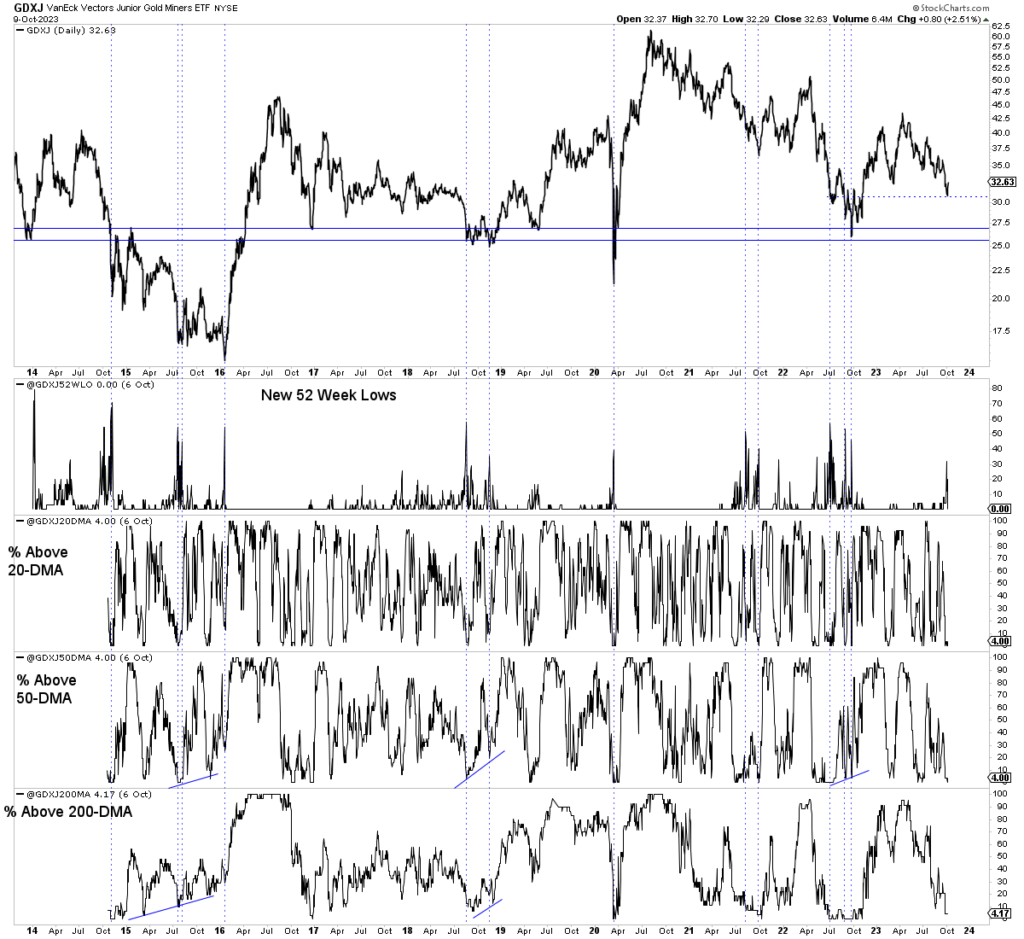

Here is GDXJ, our custom breadth indicators, and the vertical lines showing oversold extremes:

GDXJ-Daily Chart

GDXJ-Daily Chart

Last week, the breadth indicators hit extremes, including a small spike in the percentage of new 52-week lows.

The 2016, 2018, and 2022 lows required some time, while the 2020 low was an event. I suspect the 2024 low will need a bit of time.

Precious Metals are rebounding after reaching an extreme oversold condition last week. Due to the current macroeconomic conditions and some technical factors, there is a risk of more selling into 2024.

Tracking technical support, sentiment, and the breadth indicators shown above can give us a sense of when the market is ripe for a major bottom.

As I wrote in the summer, this is a time to research companies poised to benefit from the inevitable breakout and new bull market in gold.