USD/JPY: Safe-Haven Flows Are the Dominant Trade On Fear of War’s Spread

- WSJ reports Iran helped plot an attack over several weeks

- Safe-haven flows didn’t come to Treasuries as US bond markets were closed for Columbus Day

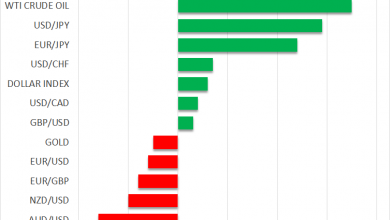

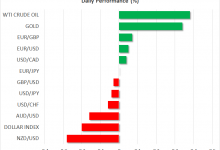

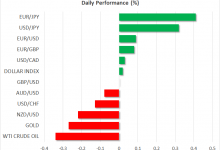

- Risk aversion across the board; S&P 500 -0.5%, Gold +1.1%, WTI crude +4.3%, and USD/JPY -0.5%

US stocks dropped in the wake of the Hamas attack on Israel but have pared losses after Fed’s Logan downplayed the need for more rate hikes. It was supposed to be a quiet Monday morning given the Columbus Day holiday, which includes the closure of the US bond market. A weekend attack on Israel by Hamas triggered a wave of safe-haven flows towards, bunds, oil, and gold.

The start of the trading week was all about positioning given the start of a new war, China’s return from a 10-day holiday, and the aftermath of a hot US jobs report. Over the weekend, a conflict in Israel triggered a wave of risk aversion that sent safe-haven flows toward the Dollar, Yen, gold, and bunds.

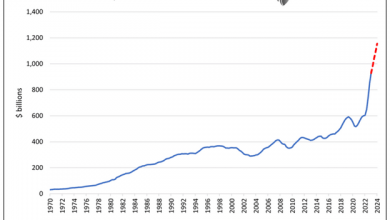

Bund yields initially fell and oil prices surged on fears of a wider conflict across the Middle East. With the US bond market closed for Columbus Day, traders are struggling to assess how this latest geopolitical risk will unfold and potentially impact inflation and growth trends. Financial markets are starting to see powerful macro drivers send bond yields all over the place. This won’t be an easy trade given the bond market is unsure how yields will react to the surge of US bond issuance and fears of a widening Middle East conflict. The longer-term market impact of the Israel-Hamas war will depend on how involved Iranians are and how much the US and international sides get involved.

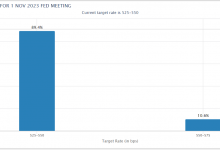

NFP Hangover

In the US, traders are still digesting a hot jobs report, which completely supports the higher-for-longer interest rate paradigm. The focus for this week was supposed to be Thursday’s CPI report, which could show headline inflation is moderating but core inflation is proving to be sticky. It seems Wall Street is getting confident that the Fed will keep rates steady in November. Fed rate hike bets could be revitalized if a sticky CPI report is followed by both an even hotter University of Michigan consumer sentiment survey and if the big banks paint a picture of a surprisingly resilient US consumer. It will take rising core inflation and a significant upside surprise for both short-term and long-term inflation expectations, for that to have a chance.

Oil

Crude prices are rallying as a new war sparks concerns of an even tighter oil market. It seems the risk that this conflict could widen and drag in the West means the risk of future sanctions against Iran are growing. This is not going to be a quick war between Israel and Hamas, which means we could see oil behave more like a safe haven if the geopolitical landscape deteriorates.

WTI crude initially surged over 5% but is now only 3% higher. The oil market will remain volatile as potential supply disruptions will also need to counter falling global travel demand. It still seems like oil prices are heading higher and eventually will comfortably find a home above the $90-a-barrel level.

Gold

Gold prices are rising as a new geopolitical risk has investors scrambling for safe-havens on a day the US bond market is closed. The Israel-Hamas war stunned markets and the risks are elevated that this could spread further across the Middle East. A resumption of a bond market selloff had gold on the ropes, but geopolitical risks just gave it a lifeline. Gold now has a floor at the $1820 level and it seems it would take a perfect storm of hot inflation readings/expectations and for the big banks to deliver an upbeat outlook on the consumer, to reassert the bearish trend.

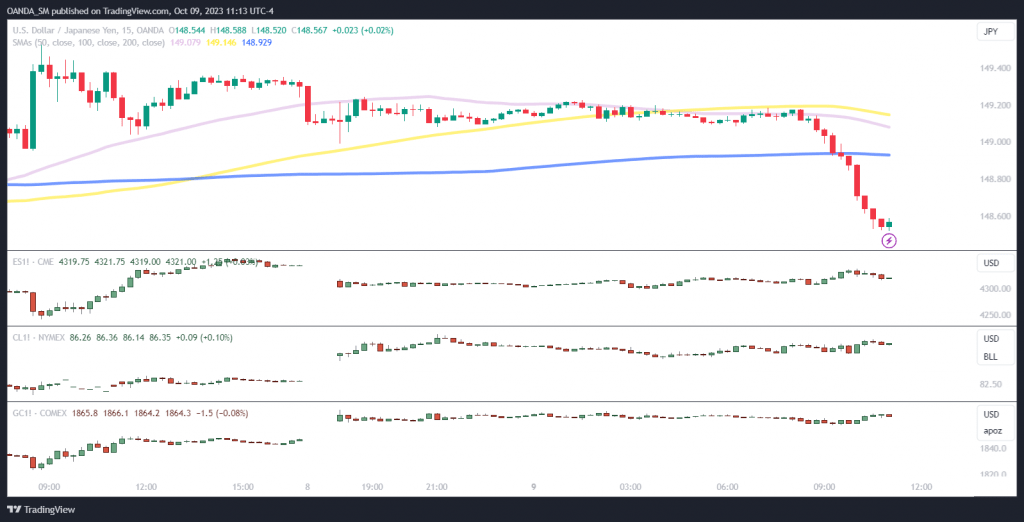

USD/JPY (15 -minute chart)

USD/JPY Chart

USD/JPY Chart

Price action on the USD/JPY shows that safe-haven flows are tentatively helping Japanese officials. No need for verbal intervention today as prices are selling off given the fears that the Israel-Hamas war will likely escalate and possibly require West involvement. The key level for USD/JPY is the 147.50 level as that is how low prices fell after what is believed to be Japan’s intervention.