Markets Keep Dropping: Is this Temporary or the Start of Something Deeper?

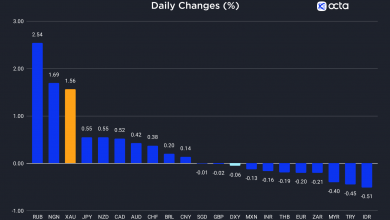

The week stated with stock markets facing pressure due to a violent attack by Hamas on Israel.

The involvement of other players, notably Iran suspected of aiding Hamas, has raised concerns of a potential full-scale conflict, prompting the United States to dispatch a squadron of warships toward Israel. Consequently, global markets are grappling with heightened turmoil and uncertainty.

In just one week, oil prices appear to have retraced their steps to pre-September levels. However, this situation remains fluid and subject to rapid changes in the days ahead. OPEC+ recently convened an online meeting to evaluate the prevailing oil market conditions.

Following the meeting, no significant alterations were announced, as both Saudi Arabia and Russia opted to maintain production cuts until year-end. In an unexpected twist, Russia decided to lift its Diesel export ban, thereby increasing oil supply and exerting downward pressure on prices. Should tensions in the Middle East not escalate further, it’s likely that oil prices may stabilize around the $80 mark.

A similar narrative unfolds for gold. Traditionally, precious metal prices tend to surge during times of conflict. However, the current environment, with high bond yields offering attractive returns, has rendered precious metals less enticing to investors.

Turning to economic data, despite the prevailing high interest rates, the economic system appears resilient. The evolving economic situation has become a focal point for investors. While some are hopeful for a crisis that might prompt central banks to lower interest rates, recent indicators suggest a different trajectory.

In the United States, the creation of 336,000 nonfarm jobs has been a positive development, and Europe is also reporting better-than-expected results.

Bitcoin the Solution?

Right now, Bitcoin is definitely one of the best assets to own.

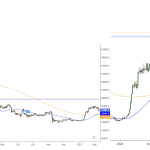

Over the past seven months, dating back to mid-March of this year, Bitcoin’s value has oscillated within the $25,000 to $30,000 range, leaving market participants uncertain about its future direction. However, there’s a growing likelihood of multiple ETFs gaining approval, potentially opening the floodgates for Bitcoin investment and making it an attractive option for financial advisors seeking to diversify their client portfolios.

I maintain my investment in Bitcoin, with a particular focus on RIOT Platforms stock, which is closely tied to cryptocurrency production.

While historical patterns suggest that conflicts can lead to temporary market declines, I remain relatively unperturbed.

China

My investment strategy continues to revolve around the Hong Kong index, targeting major stocks at discounted rates.

Recent macroeconomic data reinforces the possibility of an economic resurgence in China by 2024. During the recent national holidays, China’s domestic tourism earnings reached an impressive 753.4 billion yuan (approximately $103 billion), reflecting a 1.5 percent increase. These figures underscore the readiness of the Chinese populace to embrace life and engage in retail activities following the economic recovery. HSI 1D

HSI 1D