Verizon: Is Company’s Current 8%+ Dividend Yield Worth the Risk?

- Verizon is the second largest wireless provider in the U.S., with 143.3 million subscribers.

- The company’s broadband internet and Fios revenues rose 3.8% YoY.

- Verizon raised its dividend for the 17th consecutive year, bringing its annual percentage yield to 8.62%.

Telecom giant Verizon Communications (NYSE:VZ) shares are trading near its 52-week lows, sporting an 8.62% annual dividend yield. The company has made a conscious effort to raise its dividend annually, which it’s done for the 17th consecutive year, raising its quarterly dividend to 66.5 cents, up from 65.25 cents.

The depressed prices for the country’s second-largest wireless carrier are attracting the attention of high-yield dividend and value investors. AT&T (NYSE:T) as 229.1 million subscribers, Verizon has over 143.3 million subscribers to its wireless service, followed by T-Mobile US (NASDAQ:TMUS) with 116.7 million.

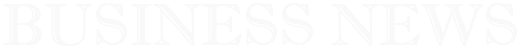

Expensive Debt Financing

Verizon is debt-ridden, with $141 billion in long-term debt. The rising interest rate climate is concerning, with some of its debt tied to a floating rate and rates up to 8.95%. The company has to refinance at ever-increasing interest rates as debt gets rolled over. The costs to service its debt have increased, taking up nearly 15% of its trailing twelve-month operation income. Interest expense is hurting Verizon, and the same story applies to telecom leader AT&T.

Potential Dividend Cut?

There’s always the threat of companies cutting their dividend as it gets too expensive, with shares falling and interest financing rising while growth stagnates. Interest payments on debt come directly from free cash flow (FCF), a key factor in its ability to pay dividends. Verizon is expected to generate FCF between $17 billion and $19 billion in 2023, so there are no immediate concerns about a dividend cut. Its first half of 2023 cash flow from operations was $18 billion, up from $17.7 billion in the year-ago period.

Grinding Forward

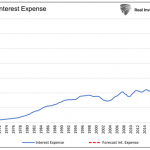

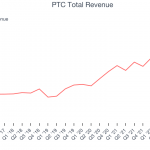

Verizon released its fiscal second-quarter 2023 results for the quarter ended June 2023. The company reported a diluted earnings-per-share (EPS) profit of $1.21, beating consensus analyst estimates by $0.04. Revenues dropped 3.5% year-over-year (YOY) to $32.6 billion, missing analyst estimates of $33.33 billion. The revenue decline was attributed to lower postpaid phone upgrade activity and reduced wireless equipment revenues.

Broadband and FIOs Additions

The company added 418,000 new broadband accounts driven by strong fixed wireless and Fios product sales. This marks the third consecutive quarter of more than 400,000 broadband additions. This adds up to 2.3 million fixed wireless service customers. Fios Internet had 54,000 net additions, up from 36,000 Fios additions.

Wireless Additions

Total wireless revenues rose 3.8% YoY to $19.1 billion. Total postpaid phone net additions were 8,000, and retail postpaid net additions were 612,000. Consumer gross postpaid phone additions grew 6.9% YoY.

Verizon CEO Hans Vestburg commented:

“We look forward to extending our network leadership in the second half of the year by continuing our rapid C-Band deployment as we are laser-focused on providing value to our customers. The steps we have taken to improve our operational performance are working, and we are confident that we will achieve our financial targets for the full year.”

Reiterated Full-Year 2023 Guidance

Verizon reiterated full-year 2023 EPS of $4.55 to $4.85 versus $4.66 consensus analyst estimates. Adjusted EBITDA is expected between $47 billion to $48.5 billion. Total wireless service revenues are expected to grow 2.5% to 4.5%.

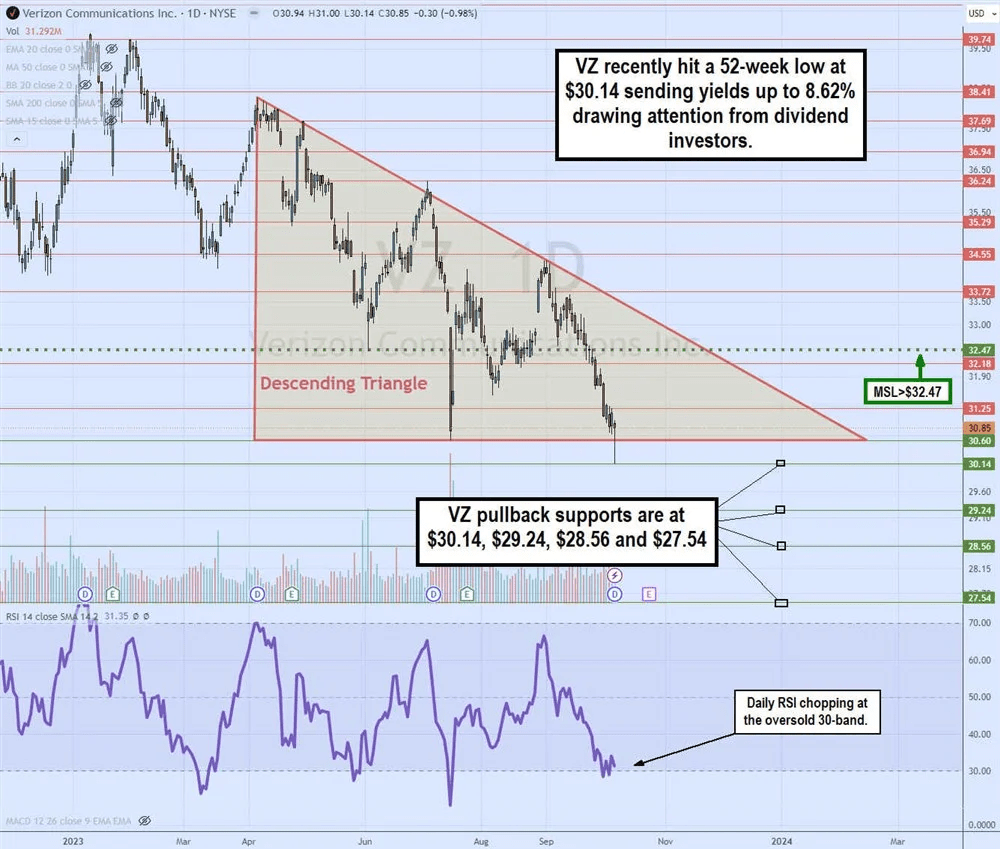

Capex spending is expected between $18.25 billion to $19.25 billion. Peak capex spending is behind them and back to normal run rate through 2024. Workforce reductions will deliver $200 million to $300 million in cost savings.  Verizon Inc-Daily Chart

Verizon Inc-Daily Chart

Daily Descending Triangle

The daily candlestick chart on VZ illustrates the descending triangle pattern that commenced in April 2023 after peaking at $38.26. Shares continued to make lower and lower highs until reaching $30.60, forming a flat-bottom trendline. The daily market structure low (MSL) trigger formed at $32.47 after bouncing from the swing low.

Shares couldn’t break through the descending trendline of $34.55 as the daily RSI continued to get smothered back down toward the oversold 30-band level. The triangle breakdown attempted to break the $30.60 level but coiled back off the $30.14 lows. The weekly relative strength index (RSI) attempts to hold the oversold 30-band, which it has defended multiple times. Pullback support levels are $30.14, $29.24, $28.56 and $27.54.