4 Stocks Set to Comfortably Beat Analyst Expectations This Earnings Season

- U.S. companies are gearing up for the Q3 earnings season

- In this article, we’ll examine five essential financial metrics to gauge a company’s health before the earnings floodgates open

- Later, we’ll take a closer look at four companies poised to announce strong earnings with positive outlooks

Earnings play a crucial role in shaping how investors perceive a company’s strength, and this, in turn, can significantly impact the performance of its stock. Today, we’ll delve into four companies set to report better-than-expected earnings soon and, possibly, promising outlooks for 2024.

But first, let’s clarify some essential financial metrics to keep in mind when assessing a company’s financial health:

- Profit: This represents the capital left after deducting the company’s expenses during a specific timeframe. In simple terms, it’s the difference between the money earned from selling goods or services and what’s spent.

- Revenue: It’s the total capital generated by a company without accounting for expenses during a given period. Essentially, it’s the pre-profit stage. For companies, profitability should always trump revenue because having high revenue doesn’t guarantee high profit. If there’s a lot of money coming in but it’s quickly spent, the company won’t thrive.

- Cash Flow: This figure reflects the net money flowing in and out of a company during a specific period. It’s crucial that this remains positive; otherwise, the company might struggle to meet its financial obligations.

- EPS (Earnings Per Share): In the United States, it’s often abbreviated as EPS. This metric represents the portion of a company’s net profit allocated to each of its outstanding shares. The calculation involves dividing the company’s net profit by the total number of common shares.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): EBITDA measures a company’s profitability before considering taxes, interest, depreciation, and amortization. Its purpose is to provide an accurate picture of what a company truly earns or loses.

Now, let’s explore 4 companies that are anticipated to deliver strong results in the current year and the next, backed by favorable ratings.

1. American International

AIG Daily Chart

AIG Daily Chart

American International Group (NYSE:AIG) is a U.S. multinational finance and insurance corporation with operations in more than 80 countries.

The corporate headquarters is located in New York and was founded on December 19, 1919, when Cornelius Vander Starr created a general insurance agency.

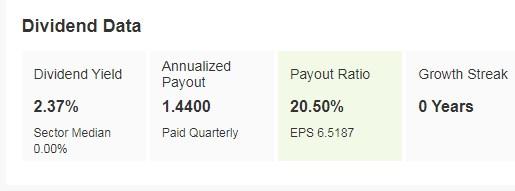

It has a dividend yield of +2.37%.

AIG Dividend Data

AIG Dividend Data

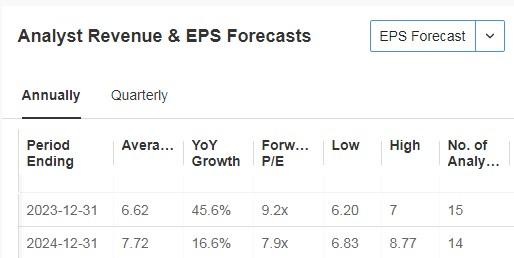

The previous results were good, achieving actual revenues above the expected +10.8%. The next results are due on November 1. EPS forecasts for 2023 are for an increase of +45.6% and for 2024 +16.6%.

AIG Analyst Revenue and EPS Forecast

AIG Analyst Revenue and EPS Forecast

With a total of 16 ratings, this company boasts a favorable outlook with 9 buy ratings and 7 holds, and there’s no sell rating in sight.

Looking at its performance, over the past year, the stock has surged by an impressive 26.7%, and in the last three months, it’s seen a respectable 5.3% increase.

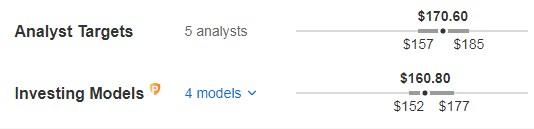

When it comes to future potential, the market anticipates a value of around $70.69. However, according to InvestingPro’s models, the company could reach an even more promising $79.26.

AIG Analyst Targets

AIG Analyst Targets

2. Assurant

Assurant Daily Chart

Assurant Daily Chart

Assurant (NYSE:AIZ) is a global provider of risk management products and services based in Atlanta. Its businesses offer a diverse set of specialty insurance products.

The dividend yield is +1.92%.

Assurant Dividend Data

Assurant Dividend Data

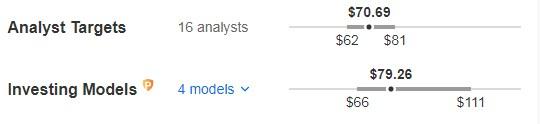

Previous results were very good with EPS beating market expectations at +41.2%. The next results are due on October 31. For 2023 as a whole, EPS is expected to increase by +11.1% and for 2024 by +13.9%.

Assurant Analyst and EPS forecast

Assurant Analyst and EPS forecast

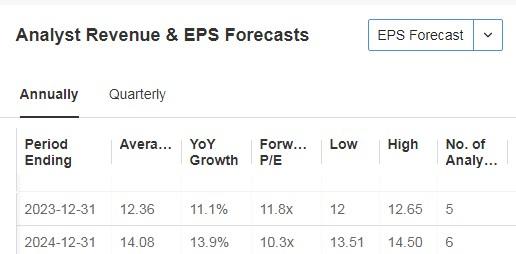

This company enjoys strong market support with 6 buy ratings and no sell ratings in sight. Over the last 3 months, its shares have seen a notable rise of +15.8%.

In terms of future potential, the market suggests a value of approximately $170.60, while InvestingPro’s models predict a slightly more conservative figure at $160.80.

Assurant Analyst Targets

Assurant Analyst Targets

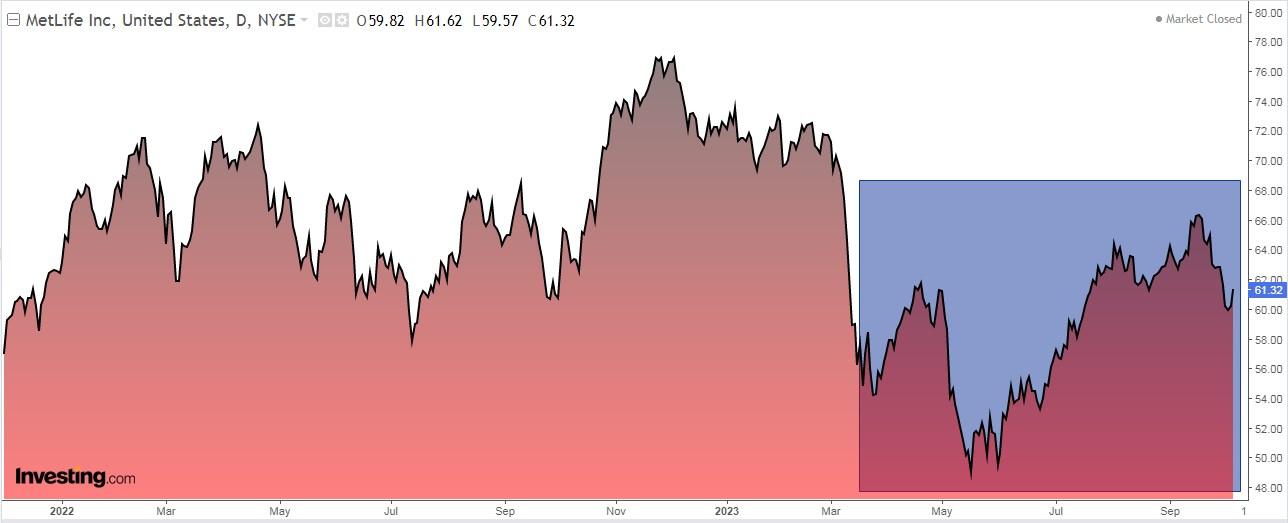

3. MetLife

MetLife Daily Chart

MetLife Daily Chart

MetLife (NYSE:MET) is the largest life insurer in the United States, a leader in savings products, retirement, and services for individuals, small businesses, and large institutions. The company is based in New York and became a publicly traded company in 2000.

Its dividend yield is +3.39%.

MetLife Dividend Data

MetLife Dividend Data

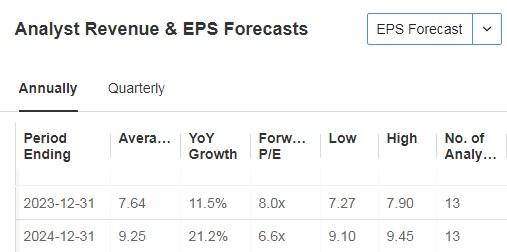

It reported good results in the previous quarter with actual revenues +10.2% higher than expected. The next results will be released on November 1. For 2023, EPS is expected to increase by +11.5%, and for 2024 by +21.2%.

MetLife Analyst Revenue and EPS Forecast

MetLife Analyst Revenue and EPS Forecast

It presents 17 ratings, of which 12 are buy 5 are hold and none are sell. At the end of the week, in the last 3 months, its shares are up +8.3%. The market gives it potential at $76.74.

MetLife Analyst Targets

MetLife Analyst Targets

4. DaVita

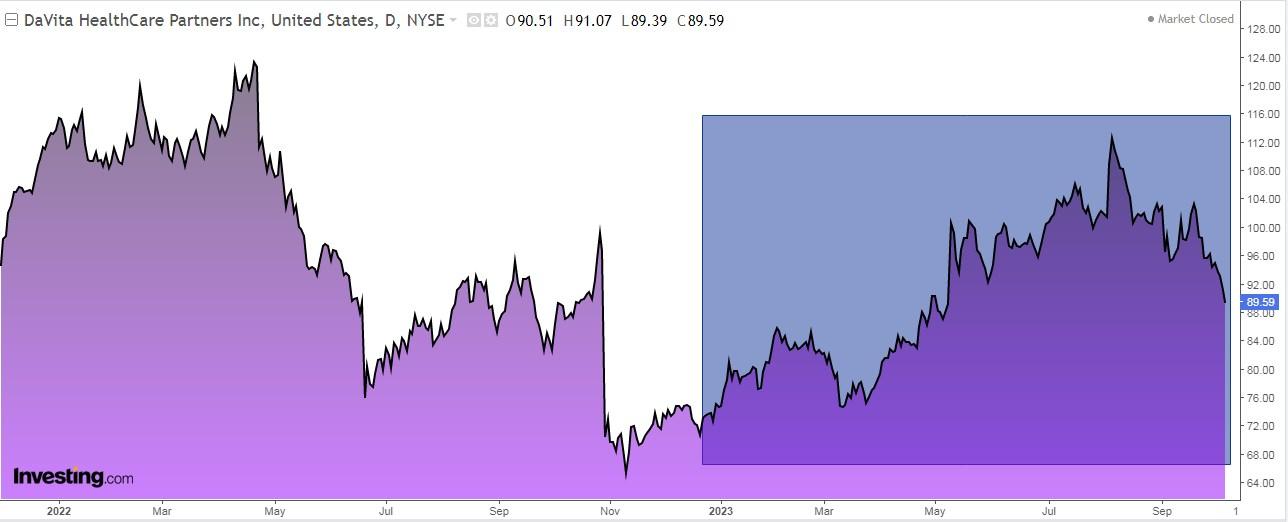

DaVita Daily Chart

DaVita Daily Chart

DaVita HealthCare Partners (NYSE:DVA) provides kidney dialysis services for patients suffering from chronic renal failure. It also provides outpatient, inpatient, and home hemodialysis services.

The company was formerly known as DaVita HealthCare Partners and changed its name to DaVita in September 2016. It was established in 1994 and is headquartered in Denver, Colorado.

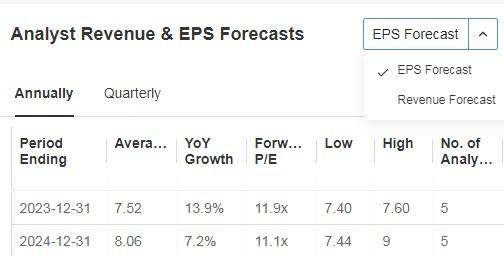

It reported good numbers in its previous quarterly accounts, with EPS up +19.8% ahead of expectations. The next quarterly earnings will be released on November 8. For 2023, EPS is expected to increase by +13.9%, and for 2024 by +7.2%.  DaVita Analyst Revenue and EPS Forecast

DaVita Analyst Revenue and EPS Forecast

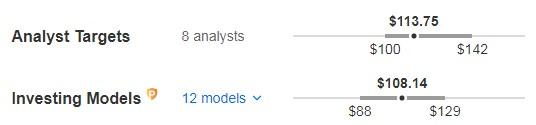

It presents 7 ratings, of which 5 are buy, 1 hold, and 1 sell. The market sees potential at $113.75, while InvestingPro models put it at $108.14.

DaVita Analyst Targets

DaVita Analyst Targets