US Stocks Climb on Speculation of Fed’s Rate Hike Pause

© Pavlo Gonchar / SOPA Images/Sipa via Reuters Connect

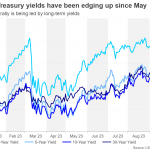

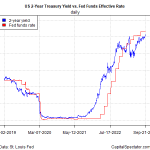

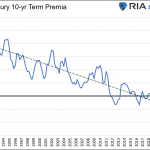

U.S. stocks experienced a surge on Tuesday, pushing the S&P 500 towards the 4,400 points mark as Treasury yields fell amid speculation that the Federal Reserve might halt its interest rate hikes. This speculation was fueled by comments from Fed Vice Chair Philip Jefferson suggesting that recent surges in Treasury yields could potentially replace further interest rate hikes.

This sentiment was echoed by Dennis DeBusschere of 22V Research. The speculation resulted in U.S.-listed Chinese shares, including Alibaba (NYSE:BABA) and Baidu (NASDAQ:BIDU), experiencing an uptick following news of China considering an increase in its budget deficit as a measure for economic stimulus.

Alongside these developments, shares of PepsiCo (NASDAQ:PEP) and Amazon (NASDAQ:AMZN) also saw gains, while oil prices slightly declined after a significant rally. In contrast, the U.S. dollar marked its longest losing streak since July with the Bloomberg Dollar Spot Index remaining steady.

In Europe, Germany’s 10-year yield advanced and the Stoxx Europe 600 rose. However, in the crypto market, both Bitcoin and Ether experienced slight declines.

Looking forward to the rest of the week, key events to watch include quarterly earnings reports from Citigroup (NYSE:C), JPMorgan, Wells Fargo, and BlackRock (NYSE:BLK). Additionally, speeches from Raphael Bostic and an International Monetary Fund (IMF) gathering are also on the agenda.