Goldman Sachs offloads GreenSky amidst rising interest rates and falling profits

In a move reflecting the impact of rising interest rates on the “buy now, pay later” industry, Goldman Sachs has sold home improvement loan provider GreenSky to a consortium that includes Sixth Street and K.K.R. The exact terms of the deal have not been disclosed but it’s known to have caused an immediate hit to Goldman’s third-quarter earnings.

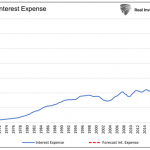

The sale comes on the heels of a decline in Goldman’s consumer banking profits, a sector that has been significantly impacted by increasing interest rates. The decision to offload GreenSky, which Goldman had previously acquired for $1.7 billion as part of its consumer-finance ambitions, indicates a potential shift in strategy. The original acquisition was intended to diversify Goldman’s client base and attract less wealthy customers, moving away from its traditional focus on affluent clientele.

However, these plans now appear to be facing obstacles. Amidst a slow period for mergers and acquisitions, Goldman Sachs CEO David M. Solomon is faced with making difficult decisions regarding the bank’s other consumer arms. This includes their credit-card business, the future of which currently remains uncertain.

These developments have contributed to a 10% drop in Goldman’s stock this year. The sale of GreenSky and the ongoing challenges faced by the bank highlight the broader struggles within the “buy now, pay later” industry amidst changing economic conditions.