S&P 500 Bounces From Oversold Levels Despite War in Middle East: What’s Next?

War broke out in the Middle East over the weekend, and no surprise, the S&P 500 opened yesterday’s session in the red.

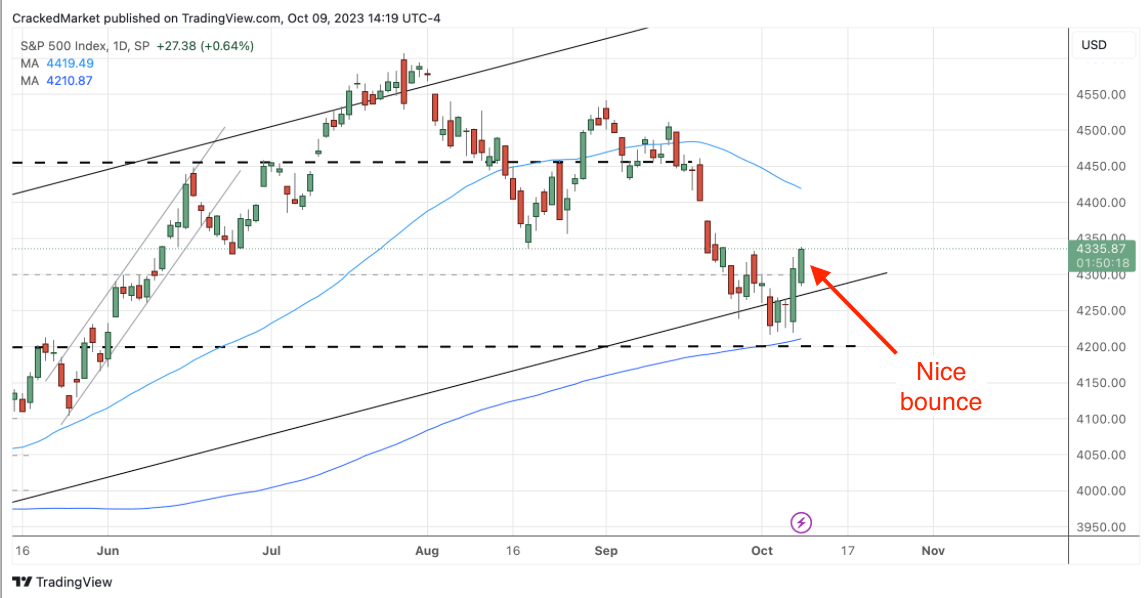

S&P 500 Index-Daily Chart

S&P 500 Index-Daily Chart

While fighting between Israel and Hamas doesn’t have a direct impact on U.S. corporate profits, the tension sent oil prices higher, adding a tax on nearly all economic activity.

But by midday, equity traders breathed a sigh of relief when oil prices only rose a few percent, allowing stocks to rebound and finish yesterday’s session nicely in the green.

As bad as everything looked last week, this weekend’s headlines made them look even worse. But paradoxically, stocks bounced hard over the last two trading sessions. Luckily, this doesn’t surprise readers. As I wrote Friday evening:

As it turns out, even war in the Middle East couldn’t stop last week’s rebound from oversold levels.

If this market wants to go down, there are more than enough reasons. The fact prices are up decisively, not down, tells us September’s selloff is running out of gas and this bounce has legs.

No matter what we think, we trade the market, not our opinions. Stocks are bouncing hard, and only fools are standing in the way.

All of us who were savvy enough to buy last week’s bounce should be moving our stops well above our entry points, turning this into a low-risk/high-reward trade.

This is the point where smart money is moving from offense to defense. Another strong session today, and it will be time to start locking in some very nice 3x ETF profits.