Safe Haven Flows Boost Gold After a Rough Few Weeks

- Geopolitical uncertainty boosts gold

- Driven lower recently by rising yields

- Fib levels may offer the biggest test of resistance

Gold is higher at the start of the week, buoyed perhaps by some safe-haven flows against the backdrop of geopolitical uncertainty. The dollar is also stronger which is typically a headwind for gold but it’s not proving particularly problematic this morning.

The yellow metal has been under immense pressure in recent weeks as investors became increasingly unsure about the inflation and interest rate environment and yields soared. That appears to have steadied for now but policymakers will have plenty of chance to calm nerves – or reinforce those concerns – this week.

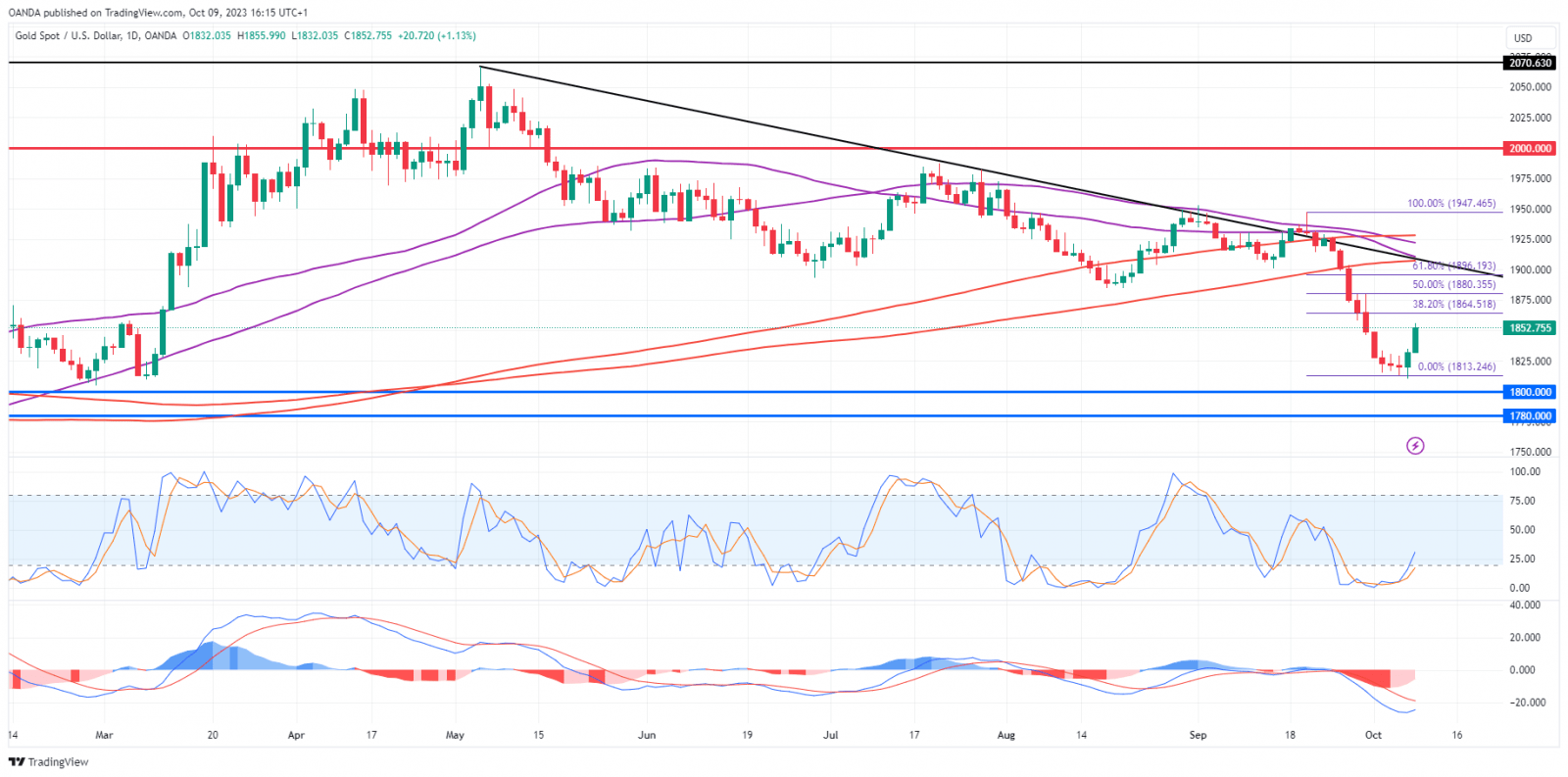

The yellow metal rebounded just above $1,800 last week with further technical support potentially being seen between that level and $1,780. Ultimately, this hangs on what bond yields are doing and, based on today’s evidence, the threat of escalation in the Middle East.

Is the Gold Rebound Sustainable?

Unless risk aversion continues to increase and the conflict escalates dramatically, I’m not sure gold’s rebound can be sustained unless other factors improve. XAU/USD-Daily Chart

XAU/USD-Daily Chart

Source – OANDA on Trading View

That’s not to say they won’t and the rebound in the last couple of sessions has been relatively strong. But it will face some big tests if it is to continue.

The Fibonacci retracement levels probably highlight the most notable tests of resistance, roughly around $1,860, $1,880, and $1,900, from the 38.2%, 50%, and 61.8% levels, respectively. A move above all of these could well change the narrative around gold.