Crude Makes Corrective Rise on Israel-Hamas Fighting

The markets kicked off the week with a tumultuous start, driven by the conflict between Hamas and Israel. Investors, seeking refuge from uncertainty, have gravitated towards the US dollar, resulting in its strengthened position. Meanwhile, the allure of gold has also resurfaced, whereas stock values have dwindled. Notably, the most significant shift has occurred in the crude oil market, witnessing a staggering 4% surge. However, it’s essential to note that energy markets could become even more unpredictable if Iran becomes embroiled in the conflict, although they presently deny any involvement in the attacks.

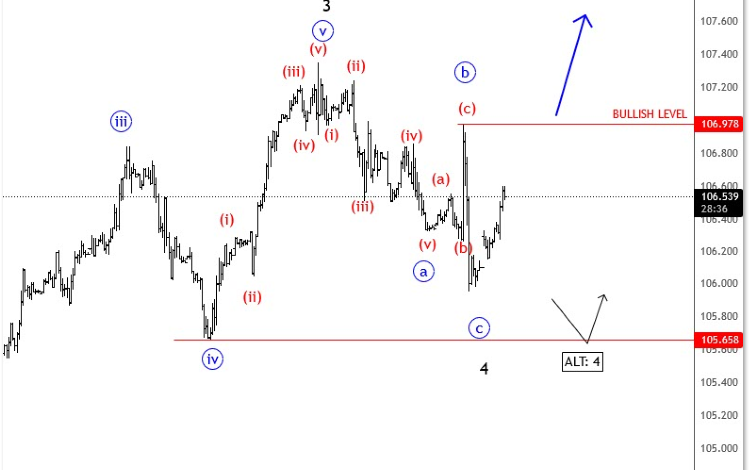

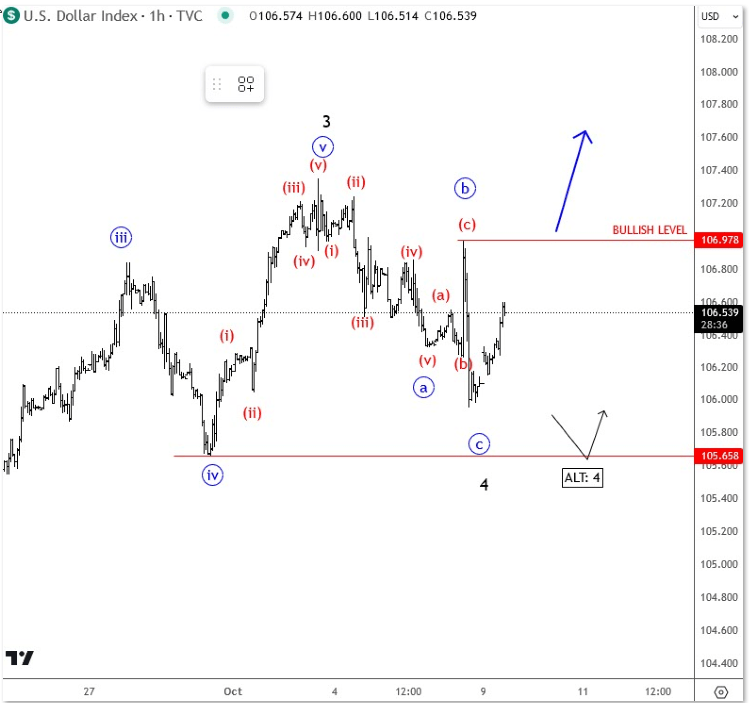

Turning our attention to the DXY (US Dollar Currency Index), we observe a notable upward movement following a recent decline, albeit it remains unclear and premature to determine whether this marks the bottom of wave 4. Support is still holding at 105.65, with the pivotal bullish level for potential further gains positioned at 106.97.

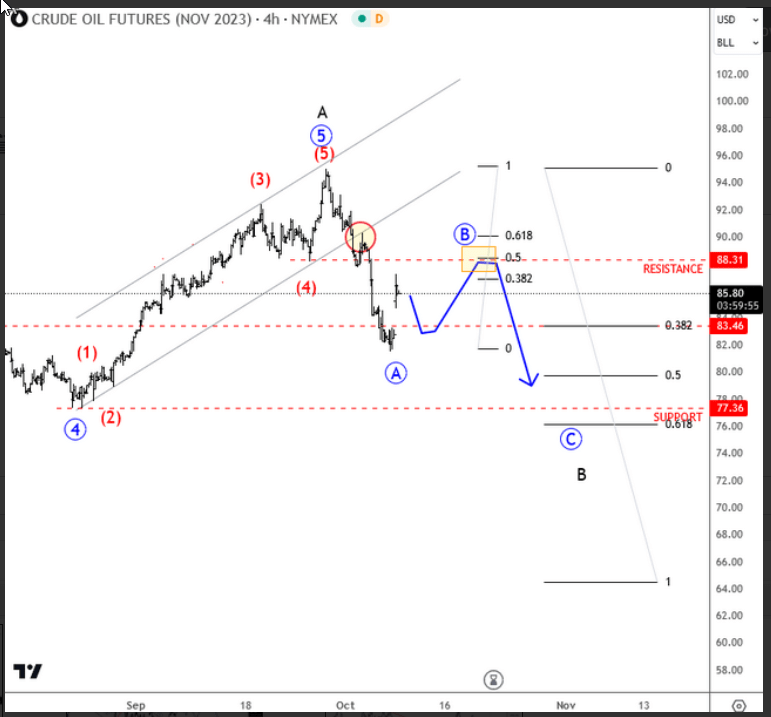

Regarding crude oil, I’m inclined to believe that if we witness further gains in the coming days, perhaps resulting in a 10% surge from last week’s lows, reaching resistance levels around 87-88, it might signify a somewhat exaggerated response. Consequently, I will be on the lookout for limited upside potential. Examining the wave structure, while there is the potential for additional upward movement, resistance is likely to be encountered around the 50-61.8% Fibonacci retracement levels after the a-b-c rally.

Grega