Gold, Silver: Will Israel-Hamas Conflict Reverse Mid-Term Bearish Trend?

- Gold and silver have rebounded as market uncertainty rose following Israel-Gaza conflict

- But, those looking to buy for a new bull market will have to be patient

- Both precious metals could rally in the long term but face headwinds in the short term

Since May, gold and silver have been in a downtrend, mainly due to the Federal Reserve’s hawkish stance which has sent long-term borrowing costs flying higher, boosting the US dollar.

Recently, selling pressure has increased, causing bullion to test a crucial support level at around $1810 per ounce.

However, the ongoing downtrend has experienced a partial interruption due to the recent escalation of tensions between Israel and Hamas, leading to an increased demand for safe-haven assets. Should the conflict intensify and trigger further shockwaves throughout the Middle East, it is likely that precious metals may garner even greater attention from potential buyers.

Still, a full-blown bull market for precious metals might take a bit longer, especially with U.S. interest rates still on the high side.

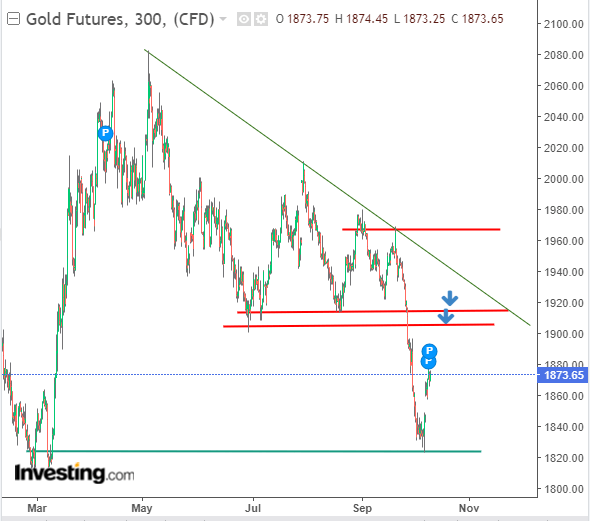

Gold’s Bounce Fizzles Out

Gold’s recent upward momentum, starting from the demand zone at $1810 per ounce, has slowed down a bit, but there’s still potential for further growth. Right now, buyers have their sights set on the resistance at around $1910 per ounce

Gold 5-Hour Chart

Gold 5-Hour Chart

In the short and medium term, a renewed attack on $2,000 per ounce could be problematic, as the Fed is not considering starting a cycle of interest rate cuts any time soon.

The likelihood of a Federal Reserve interest rate cut is currently projected for June next year.

Silver: Does the Grey Metal’s Bounce Have Legs?

Silver prices are experiencing a situation similar to gold, with a demand-driven upward movement that has recently lost some momentum.

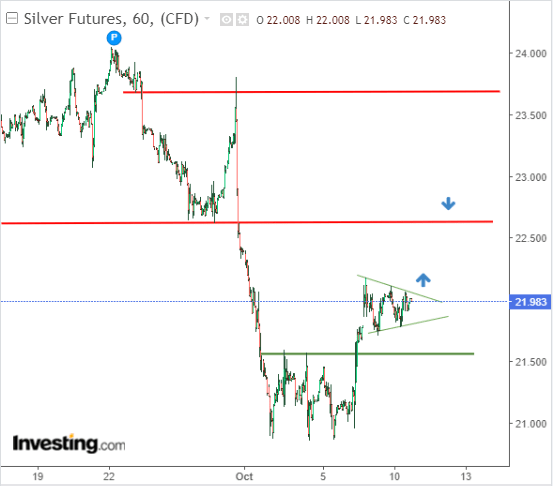

The formation of a triangle pattern suggests a potential breakout to the upside, making an upward scenario highly probable.

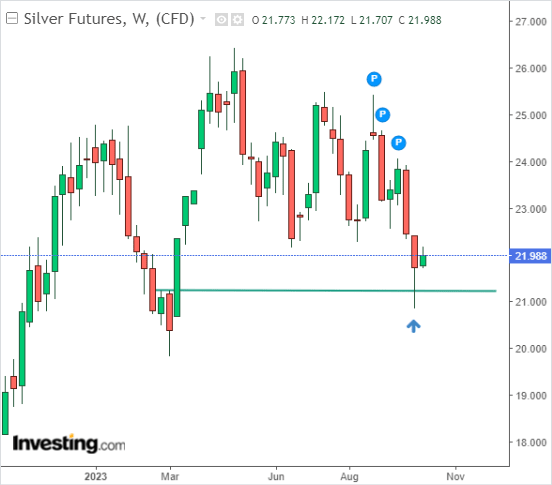

Silver Weekly Chart

Silver Weekly Chart

The base case scenario is an attack on the clearly outlined resistance area located in the area of $22.50 per ounce.

Silver Hourly Chart

Silver Hourly Chart

A potential downside scenario for silver is a decline to at least $21.50 per ounce. However, in the long term, silver is expected to have significant upside potential due to increasing demand, particularly from renewable energy sources, along with limited supply potential.

Central Banks Look to Boost Gold Reserves

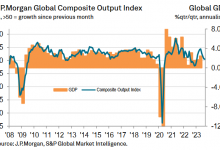

Meanwhile, central banks have been steadily increasing their gold reserves since around 2010. Their purchases of this precious metal are motivated by a desire to diversify their holdings, enhance the credibility of their institutions, and bolster the overall safety of the financial system.

Gold is regarded as a safe haven asset that can be easily liquidated when needed. Presently, the countries with the largest gold reserves in the world include the United States, Germany, Italy, France, and Russia. However, according to data for Q2 of this year, Poland, with 48.41 tons of gold, and China, with 45.1 tons, have been leading in terms of boosting their gold reserves.

***

Find All the Info you Need on InvestingPro!

Find All the Info you Need on InvestingPro!