Papa John’s International Stock Set to Bounce Higher?

Almost a year ago, on October 20, 2022, we examined the daily chart of Papa John’s International (NASDAQ:PZZA)l for Elliott Wave patterns. The stock was down by 50% from its all-time high of $140 reached in November 2021. At the time, the Fed was aggressively raising interest rates and a recession looked imminent. This didn’t bode well for stocks in general, PZZA included. After a quick look at its daily chart, however, we arrived at a different conclusion.

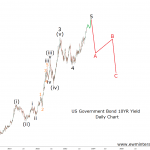

The pattern we found was a textbook five-wave impulse to the downside, labeled 1-2-3-4-5 in wave A. The five sub-waves of wave 3 were visible, as well. According to the theory, a three-wave correction follows every impulse. So instead of extrapolating the recent selloff into the future, we thought it was time for a notable wave B recovery in PZZA stock.

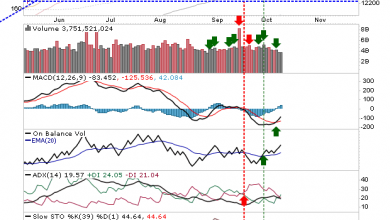

Supporting the short-term positive outlook was a bullish MACD divergence between waves 3 and 5. If this analysis was correct, the price was supposed to approach the $100 mark. Once there, however, the 5-3 Elliott Wave cycle would be complete and it would be time for wave C to drag the stock to new lows. The updated chart below shows how the situation developed. Papa Johns Stock-Daily Chart

Papa Johns Stock-Daily Chart

The Bulls took the wheel right away in late 2022. By mid-February, 2023, they had already pushed the stock to the vicinity of $98 a share. Wave B took the shape of a perfect a-b-c zigzag correction. The resistance of wave 4 proved too strong to breach, however, and a bearish reversal soon followed. Last week, PZZA stock breached the bottom of wave A and dropped to a new low of $61.79. Elliott Wave analysis managed to put us ahead of both the rally and subsequent decline.

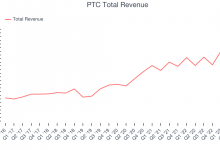

There are two problems the bulls need to face, though. One, wave C is still incomplete, which means the downtrend remains in progress. And two, even after the recent fall, Papa John’s valuation remains quite high at 21 times its expected 2024 earnings. Given the high probability of a recession next year, those EPS estimates might turn out to be too optimistic. Instead of “buying the dip” in PZZA stock, we think investors should brace for more pain ahead.