U.S. jobs growth unexpectedly spikes in September

Investing.com — U.S. job growth unexpectedly surged in September, while the unemployment rate and wage growth held steady, pointing to a lingering tightness in the labor market that could impact Federal Reserve monetary policy over the rest of the year.

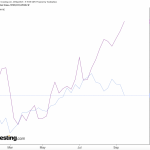

Nonfarm payrolls increased by 336,000 last month, the Labor Department said in its closely-monitored employment report on Friday, well above the 170,000 estimated by economists. Data for August was revised to show 227,000 were added instead of the previous reading of 187,000.

Average hourly earnings grew by 0.2% month-on-month, in line with August and below projections of 0.3%. The unemployment rate was unchanged at 3.8%, just faster than expectations of 3.7%.

A parade of data in recent days had presented a nascent narrative of a resilient, but possibly gradually softening, labor market. Along with a weaker-than-projected jump in weekly initial applications for unemployment benefits, private payrolls rose by less than anticipated last month and job openings surprisingly ticked up in August.

Markets and policymakers alike are on the lookout for any signs of strength in the jobs market. A central tenet of the Fed’s aggressive campaign of interest rate hikes has been a slackening in labor demand, which in theory could contribute to slowing wage gains and help inflationary pressures abate.

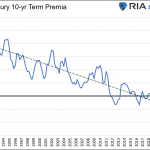

U.S. Treasury yields, which have been in focus this week as they touched 16-year highs, climbed in the wake of the jobs report. Yields move inversely to prices. In a post on X, formerly known as Twitter, Charles Schwab (NYSE:SCHW) Fixed Income Strategist Kathy Jones noted that the rise in yields reflects expectations that the labor figures “[keep] another Fed rate hike on the table by year-end.”

Meanwhile, the U.S. dollar index — a tracker of the greenback against a basket of other currencies — moved higher and stock futures on Wall Street turned negative.