NFP Preview: EUR/USD Bearish Trend Intact Below 1.0530

- NFP is expected to show 171K net new jobs and average hourly earnings rising 0.3% m/m.

- Only a stellar report would put a Fed rate hike in play for November.

- EUR/USD remains in a bearish channel with resistance at 1.0530.

The Non-Farm Payrolls report for August will be released on Friday, October 6 at 8:30 ET.

Traders and economists are expecting the NFP report to show that 171K net new jobs were created in September and that average hourly earnings rose 0.3% m/m.

September NFP Preview and Forecast

Confounding economists and traders alike, the US labor market remains perplexingly strong. While recent NFP readings have moderated slightly – the 3-month average of jobs created stands at 176K prior to Friday’s revisions – they are still more than enough to keep up with population growth. More to the point, other measures of the jobs market remain relatively tight.

As for the impact on policy, it would take a particularly strong jobs report to tilt the Fed toward hiking interest rates at its November meeting, a possibility that the market is assigning just a

By now, most regular readers know that we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Manufacturing PMI Employment component printed at 51.2, up a point from last month’s 48.5 print.

- The ISM Services PMI Employment component printed at 53.4, down a point from last month’s 54.7 print.

- The ADP Employment report came in at just 89K net new jobs, above expectations and in-line with last month’s 180K reading.

- Finally, the 4-week moving average of initial unemployment claims fell to 209K, down from 229K last month.

Weighing the data and our internal models, the leading indicators point to a roughly in-line reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 150-225K range.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which rose 0.2% m/m last month, will likely be just as important as the headline figure itself.

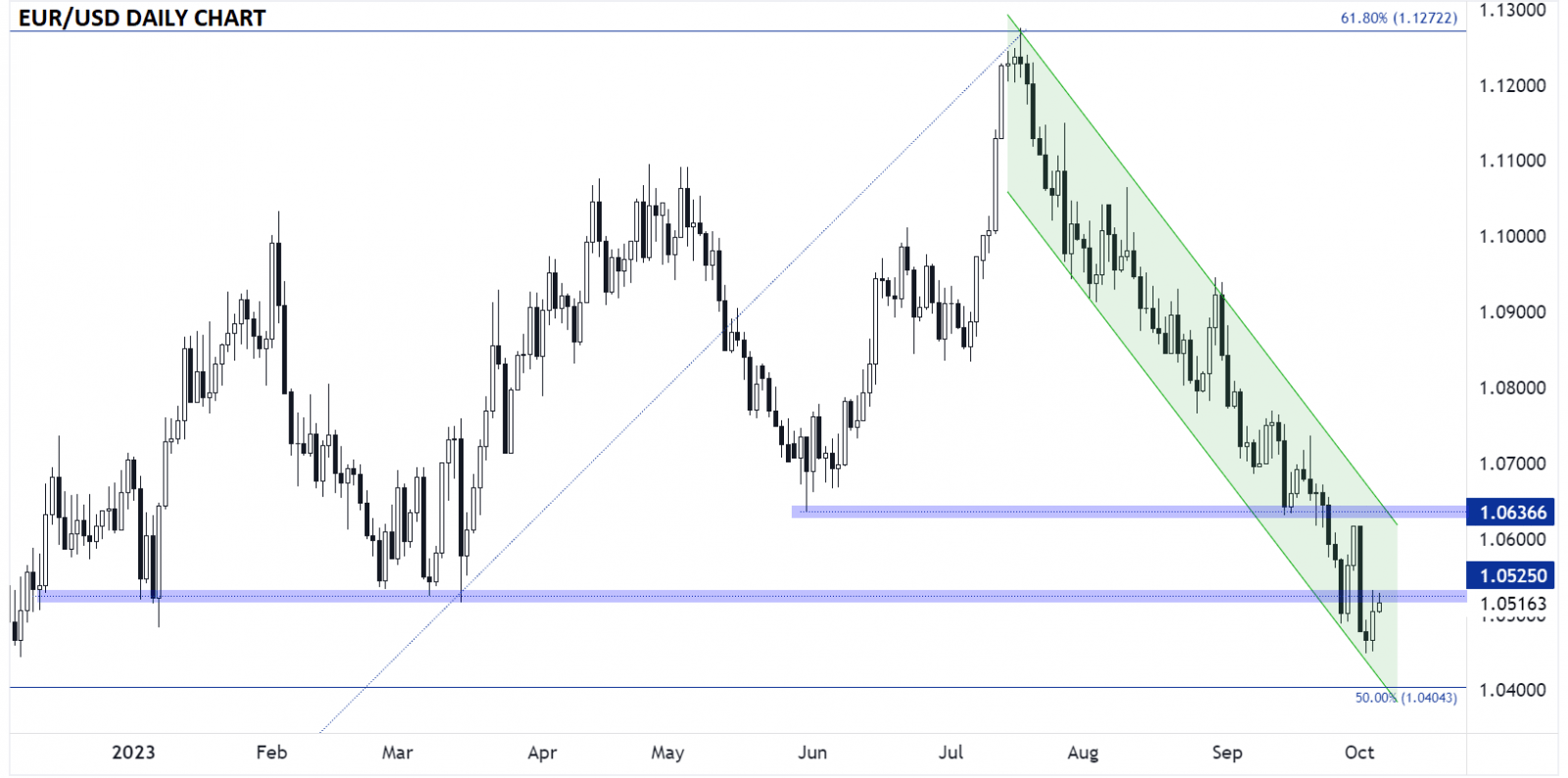

Euro Technical Analysis – EUR/USD Daily Chart EUR/USD-Daily Chart

EUR/USD-Daily Chart

Looking at the chart of the world’s most widely-traded currency pair, EUR/USD remains within a well-defined bearish channel. The pair broke below key previous support in the 1.0530 area earlier this week and is now testing that level from the underside.

A basic principle of technical analysis called “polarity” states that previous support, once broken, can become future resistance, and that’s exactly what we’re seeing in EUR/USD so far.

As long as the NFP report is decent, leaving the door open for another Fed rate hike this year, EUR/USD is likely to remain in its bearish trend.

To the downside, the next support levels to watch are near 1.0400, the 50% retracement of the whole 2022-2023 rally, followed by the 61.8% Fibonacci retracement at 1.0200. Meanwhile, a break above 1.0530 could point to a rally toward the top of the bearish channel in the 1.0625 zone later this month.