NZD/USD: Bounce Limited as RBNZ Rate Hike Odds for November Underwhelm

- Fed’s Daly (non-voter) noted that recent bond market tightening equals about 1 rate hike; if the labor market cools, we can hold rates steady

- RBNZ rate hike expectations are between a hold or one more rate hike

- China’s improving outlook could boost commodities

The New Zealand central bank is keeping all their options open after keeping rates on hold this week, refraining from signaling that the inflation outlook could warrant further tightening. Since the RBNZ expects inflation to fall to their 1-3% target band by the second half of 2024.

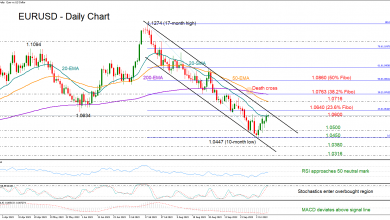

If China’s outlook does improve as most investment banks are expecting, that could prove to be inflationary for New Zealand and help drive that one last rate hike by the RBNZ. Chinese data has turned the corner as additional policy support has got the economy heading back in the right direction. NZD/USD-Daily Chart

NZD/USD-Daily Chart

The Fed has mostly been maintaining a hawkish stance, providing comments that support higher-for-longer. Fed speech from Barkin and Daly did little to imply the economy warrants a change in policy. The big question FX traders have for NZD/USD is what happens after tomorrow’s NFP report. The outlook for the US dollar will depend if Wall Street believes the labor market is softening enough. If NFP Friday shows job growth remains strong, the Kiwi rebound will likely be short-lived, and technical selling could target the 0.5740 level. It is around that area that price could form a bullish Gartley. Point D is targeted by the 78.6% Fibonacci retracement of the X to A move and the 161.8% Fibonacci expansion level of the B to C leg. If valid, a bullish reversal could target a major rebound toward the 0.5945 region. If invalidated, downward pressure could look to retest last year’s low at around the 0.5512 level.