Is It Finally Time to Go Contrarian on the Bond Market?

Psychology in markets is always fascinating. In February 2009, I wrote While in hindsight, it is easy to see that was the right call, overall, psychology was highly negative at the time.

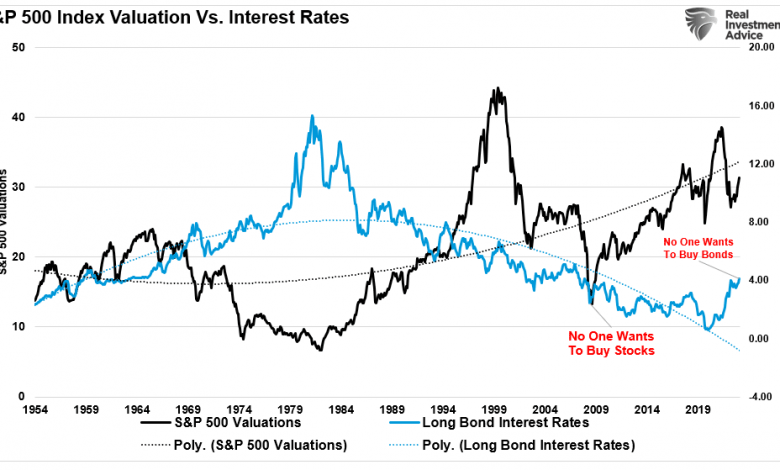

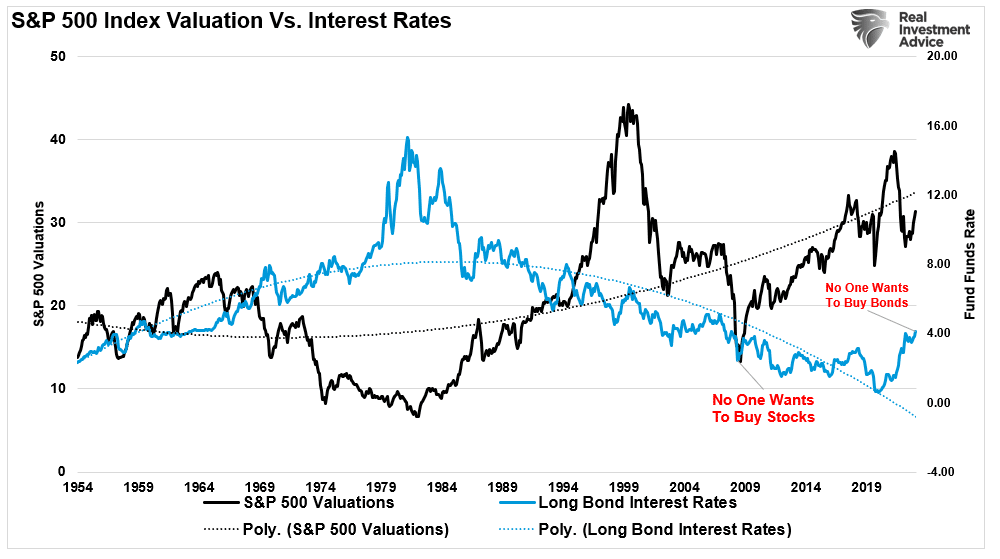

The arguments for lower stock prices and a continued economic recession were rampant. Most importantly, investor psychology was extremely bearish, and stock valuations were dramatically cheaper. It is the opposite today, with investors shunning cheap bond valuations in favor of overvalued equities.

Stock Valuations vs Interest Rates.

Stock Valuations vs Interest Rates.

Another example was in 2021. Following the crash in oil prices and the ESG movement, we made the case for owning energy stocks as investors shunned energy companies.

They were the best-performing asset class in 2023.

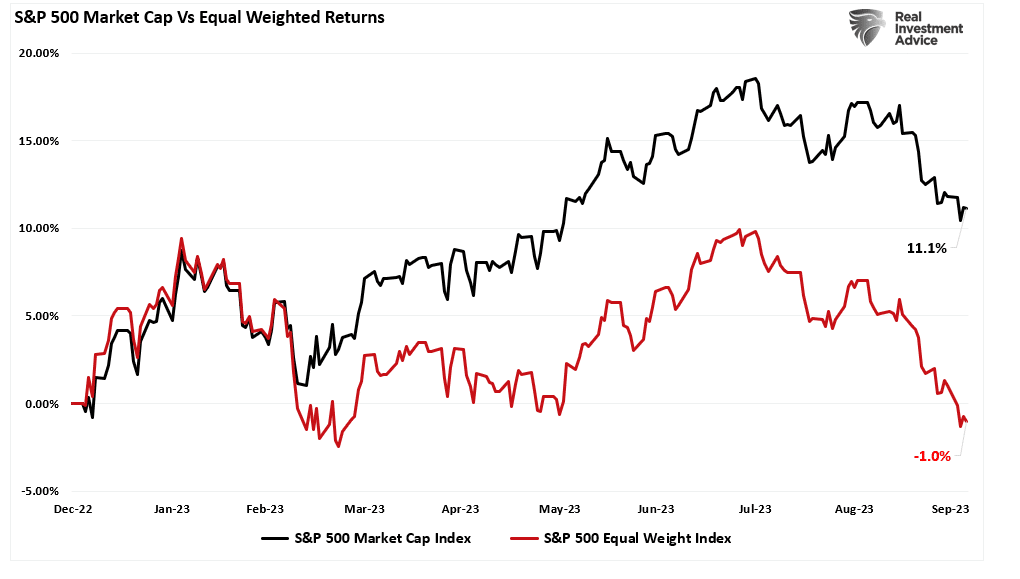

Again, in November 2022, we wrote an article discussing the perceived ‘death’ of FANG stocks. The reason was the extreme pessimism in the sector during the market correction. To wit:

Unsurprisingly, 2023 has been the year of the stocks driving the overall market returns. S&P 500 Market Cap vs Equal Weighted Returns.

S&P 500 Market Cap vs Equal Weighted Returns.

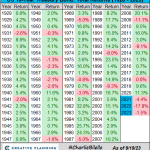

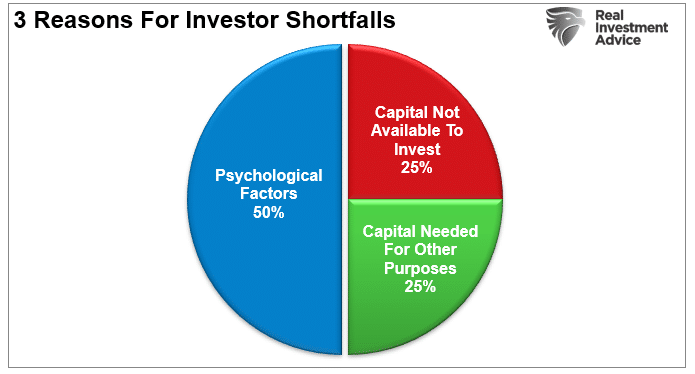

Throughout history, whenever most investors believed the worst about a particular asset class, such has often been the right time to start buying. As we have often discussed, psychological behaviors account for as much as 50% of the reasons investors consistently underperform the markets over the long term.

Dalbar Reasons For Underperformance

Dalbar Reasons For Underperformance

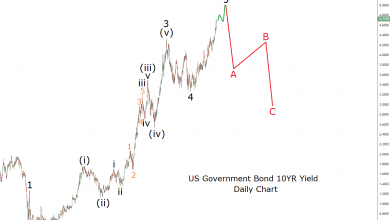

This brings us to the currently most hated asset class: bonds.

Bond Valuations Are Attractive

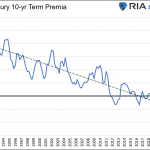

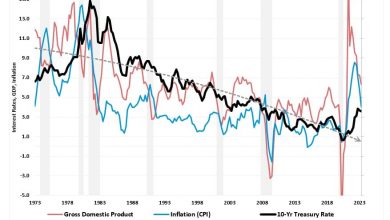

We have written many articles about the underlying economic drivers of interest rates and why To wit:

“

Fed Funds vs 2-Year Treasury vs S&P 500

Interest Rates vs GDP-Inflation Composite

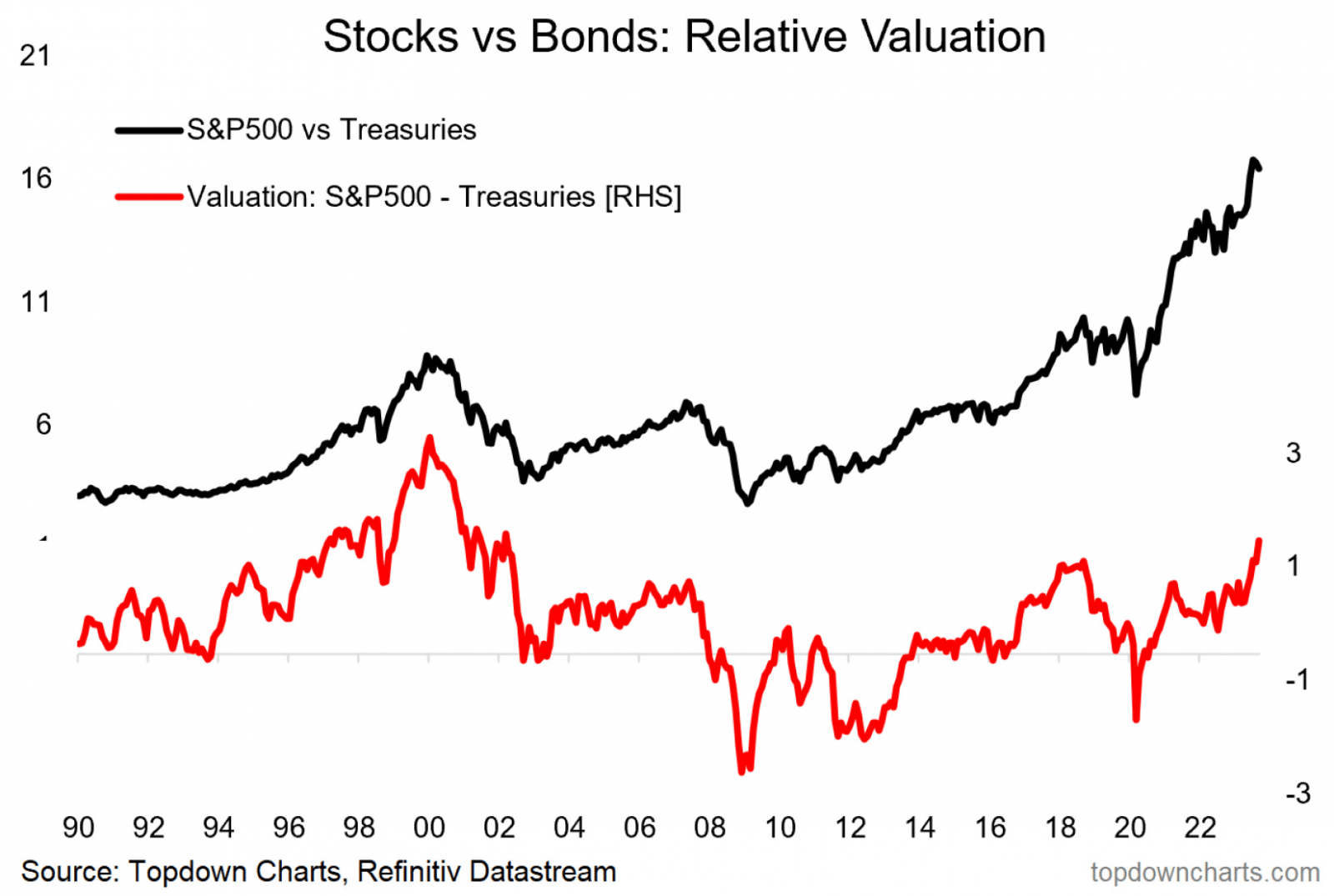

Of course, there are periods where interest rates can, and do, diverge from the underlying economic fundamentals. We are experiencing one of those periods which brings up the issue of valuations.

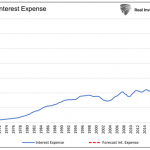

Just as stocks can detach from underlying fundamental realities and become over or under-valuated, so can bonds. As we noted last week, the record short position in bonds and computerized algorithmic trading has pushed yields substantially higher than the economic data and, ultimately, bond valuations would suggest. As noted recently by Top Down Charts:

–

Stocks vs Bonds Relative Valuation

Stocks vs Bonds Relative Valuation

In other words, expect bonds to outperform stocks in the future.

Contrarian Investing Is Hard

From a contrarian investing view, everyone is so bearish on bonds that it is a bullish signal. The problem with contrarian investing is that it is hard to do and harder to go against seemingly common wisdom. As Howard Marks once wrote:

“

However, as Dalbar notes above, the psychological failings of investors continually lead to long-term underperformance.

Think about it this way. If the goal of investing is to buy something when it is cheap, those opportunities don’t exist in bull markets. Buying something of value but is truly undervalued can ONLY occur when no one wants to own a particular asset. There are a couple of caveats to that statement. As an investor, you must know the asset’s actual value and be willing to hold it long enough for the market to recognize it.

For most investors, investing and being willing to for an extended period is difficult. Eventually, psychological pressures outweigh investor convictions. Whether it’s performance chasing, herding, or loss aversion, eventually, investors abandon their positions before the value is recognized.

As Howard Marks said:

an investor has to be a “ –

Valuations are always the key to winning the long-term investing game.

For us, bonds remain one of the best values around.