Fund Flows Into Bonds Suggest Eventual Unwind of Bearish 10-Year Treasury Trade

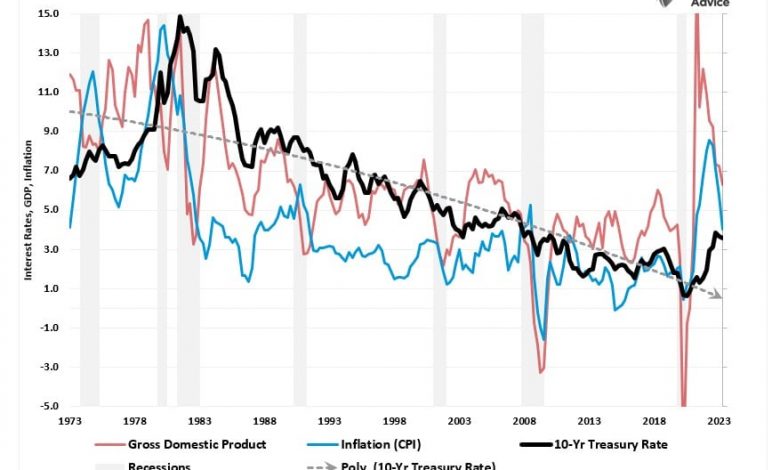

While bond yields have risen sharply lately, fund flows into bonds tell two very different stories. We have previously written much on the recent rise in bond yields related to economic growth, event risks, and recessions.

“

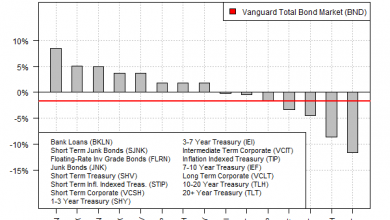

Interest Rates Vs GDP Vs Inflation

“

Rates vs GDP and Inflation Composite

Of course, that analysis contradicts the views of Ray Dalio, Bill Ackman, Bill Gross, and others who currently expect rates to go higher. The disconnect comes down to time frames. More importantly, investors must understand the difference between short-term market-driven narratives and the long-term economic dynamics that drive interest rates.

Such is the basis for our discussion in this blog.

Traders Are Heavily Short Bonds

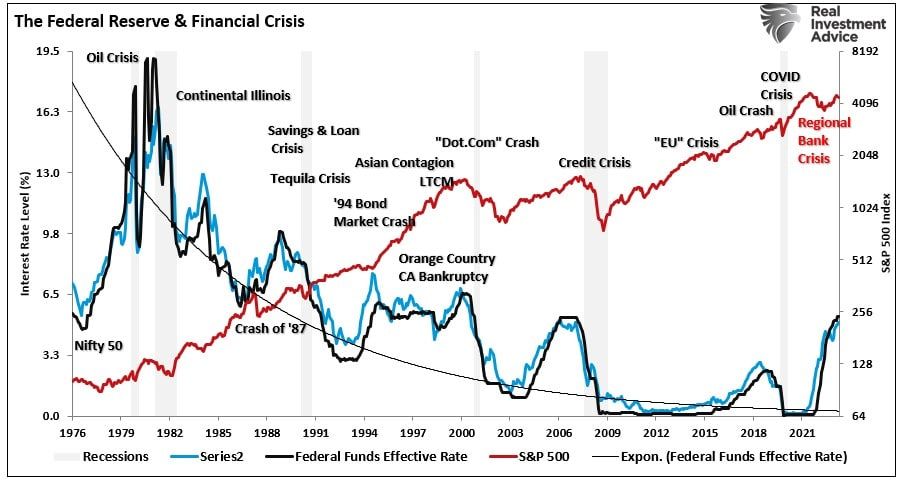

Over the last two years, interest rates on Treasury bonds have risen in response to two primary factors. On the short end of the Treasury curve, the 1-month to 2-year Treasury bonds are heavily influenced by the Federal Reserve’s monetary policy changes. As shown, there is an exceedingly high correlation between the Fed funds rate and the 2-year Treasury.

Federal Reserve and Financial Crisis

Federal Reserve and Financial Crisis

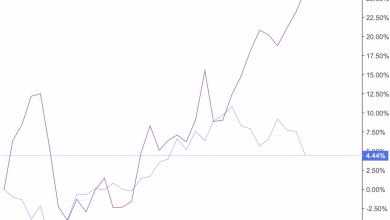

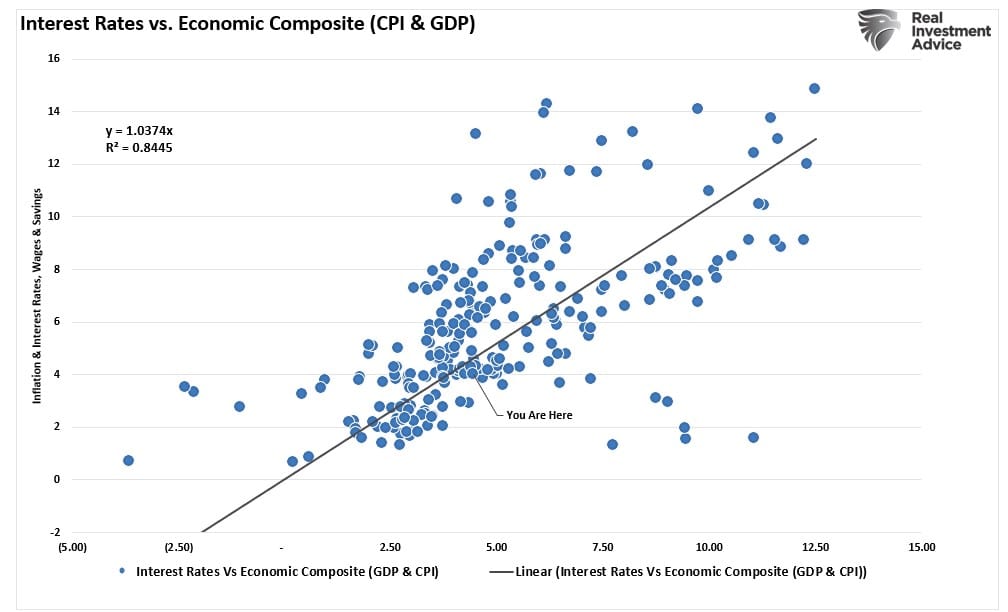

However, the long-end of the yield curve, 10-year Treasury bonds or longer, are driven almost entirely by expectations for economic growth, inflation, and wages, as shown above. Notably, the correlation is very high.

Interest Rates vs CPI and GDP

Interest Rates vs CPI and GDP

Of course, there are periods where interest rates can, and do, diverge from the underlying economic fundamentals. We are experiencing one of those periods, driving the view that

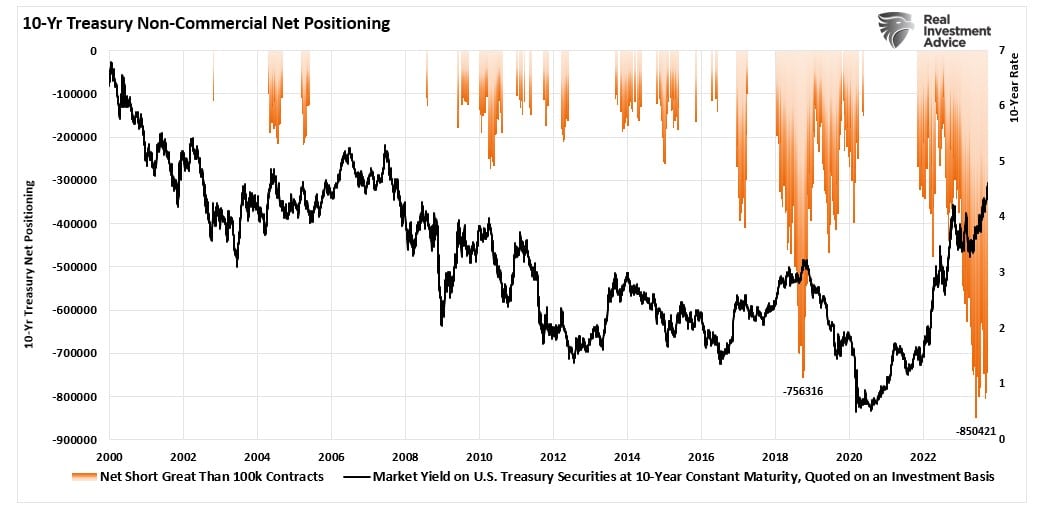

As we have discussed, the Commitment Of Traders (COT) report gives us some insights into what major fund managers, hedge funds, and commodity traders are doing. Given that yields on bonds are solely a function of the changes in price relative to its coupon, differences in yield can be influenced by market-driven actions in the short term.

The most recent COT report currently shows a record number of short positions against Treasury bonds. That “selling” pressure has pushed prices lower and yields higher, as shown below. We saw a similar episode during the in 2018. 10-Year Tresaury Net Short Positioning

10-Year Tresaury Net Short Positioning

Notably, when something those heavily Treasury bond traders will be forced to cover those speculative positions. In 2018, the reversal of those speculative short positions on bonds was caused to cover as the Federal Reserve stepped in with a massive program to bail out hedge funds.

As noted by TheStreet.com recently:

Of course, while rates rise and speculative traders short bonds, you might think no one is buying bonds.

However, you would be wrong.

Follow The Money

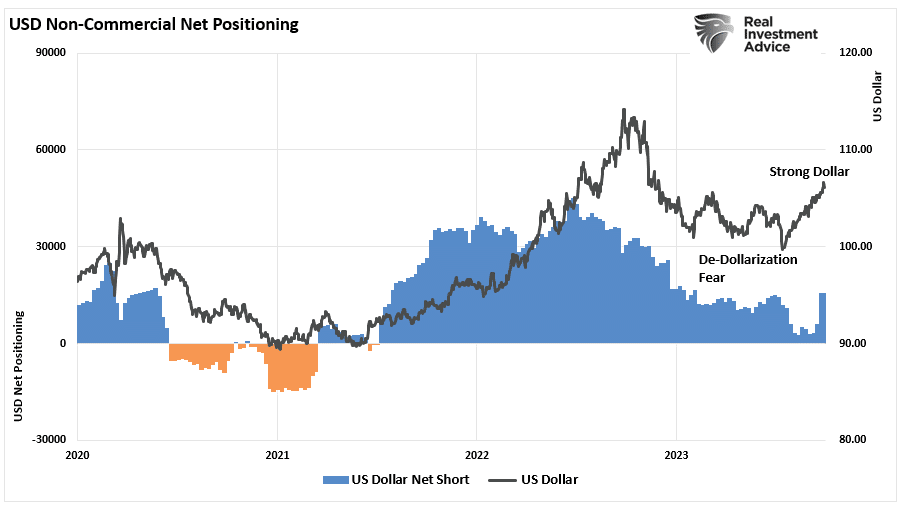

While speculators potentially drive higher yields in the short term, pay attention to fund flows. Two pieces of evidence suggest that rising yields aren’t a function of a lack of buyers. The first is the US Dollar index.

Last year, there was a significant concern about a collapse in the U.S. dollar as would cause the loss of the reserve currency status. As both Michael Lebowitz and I discussed at the time, such would not be the case.

This backdrop for the dollar is not changing anytime soon. According to the IMF, the dollar makes up almost 60% of global foreign exchange reserves. While the percentage has declined by about 10% over the last decade, it is still three times the next leading reserve, the Euro, which accounts for about 20% of global reserves. For those concerned about China, their currency, the renminbi (yuan), accounts for 2.5% of all reserves.

Not surprisingly, as the U.S. economy is more robust than its counterparts, and the yield on the 10-year Treasury bond is substantially higher, foreign excess reserves are now flowing into the US Dollar.

USD-COT Positioning

USD-COT Positioning

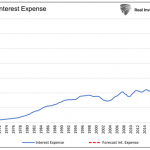

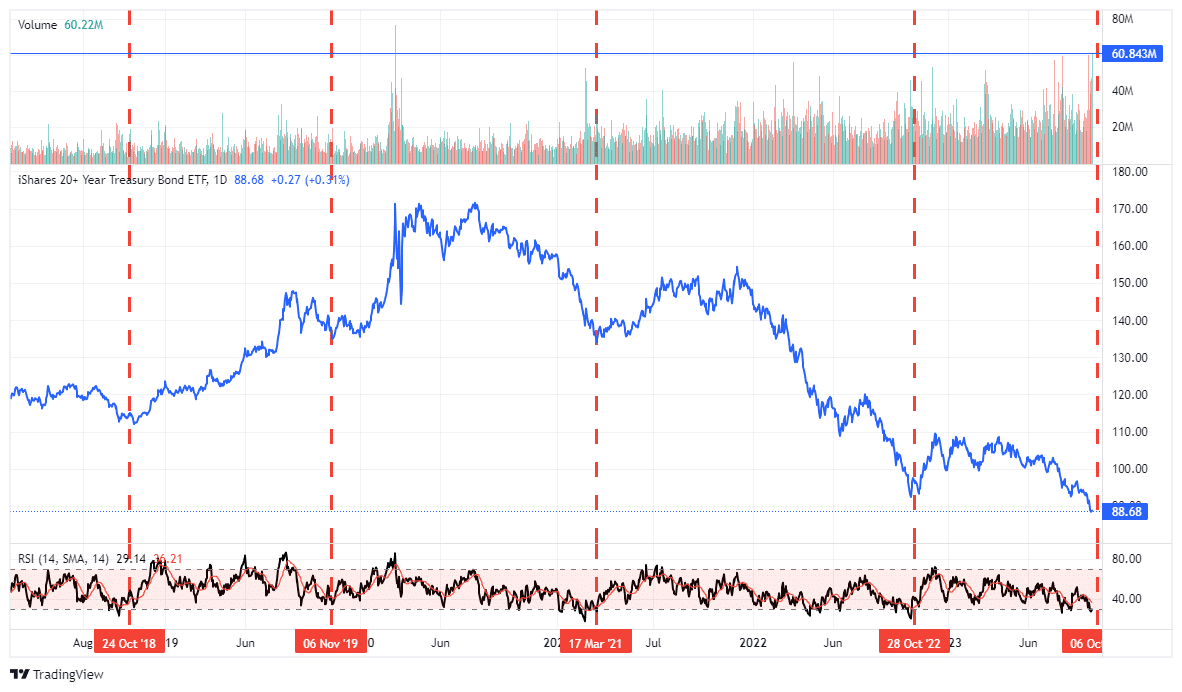

When reserves flow into the US dollar, those dollars are converted into U.S. Treasury Bonds. Such is why inflows into Treasuries continue to grow despite traders’ record short-position in Treasury bonds. As shown, the volume of fund flows into bonds is the highest since the 2020 economic shutdown. Volume of Fund Flows Into Bonds

Volume of Fund Flows Into Bonds

While interest rates have stayed elevated, investors have turned to longer-term funds. As noted by Morning Star:

“

For investors, the current rise in yields has undoubtedly been concerning. That rise, coinciding with much media spin about the and certainly fueled the fears of spiraling interest rates.

However, when we the fund flows suggest a different outcome.