Fed’s data-dependent strategy battles inflation, aims for soft landing

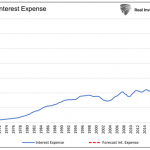

The US Federal Reserve has been leveraging data-dependent policy changes to address persistent inflation and avert a potential recession, as stated by top officials on Wednesday. The central bank’s key interest rate has reached a 22-year high, although the pace of hikes has recently slowed down. The Fed is currently facing challenges as consumer inflation consistently exceeds its two percent target.

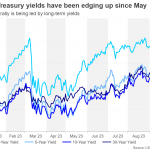

Minneapolis Fed President Neel Kashkari anticipates a “soft landing,” implying effective control of inflation without triggering a recession, supported by a robust labor market. Dallas Fed President Lorie Logan suggested that high long-term interest rates, marked by the 16-year peak of 10-year US Treasury yields, might reduce the necessity for additional rate increases. These elevated yields could potentially increase consumer borrowing costs, possibly slowing economic growth and mitigating price rise.

On Wednesday, Fed Governor Christopher Waller asserted at a Utah conference that the Federal Reserve’s actions to counter inflation are yielding positive results, with the US economy demonstrating resilience. Over the past year and a half, the Fed has boosted interest rates to a 22-year apex in an effort to reach its long-term inflation target of two percent. Despite consumer-level inflation remaining high since its peak last summer, the economy continues to show strength with solid domestic spending and a tight labor market.

Waller, who is also a member of the Federal Open Market Committee (FOMC), pointed out recent promising inflation data and hinted that if current trends continue, the target could be achieved. The Fed has lately moderated its rate hikes to attain a “soft landing”, i.e., curbing inflation without inducing a recession. Waller also mentioned strong GDP growth forecasts above four percent for Q3.

However, fellow FOMC member Michelle Bowman expressed a more hawkish view on future rate policy at a conference in Morocco, suggesting that the policy rate might need to be raised further. According to CME FedWatch data, there is a 90% probability that the Fed will keep its benchmark lending rate unchanged next month.