Fed officials hint at stable interest rates amidst surge in long-term yields

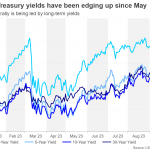

Federal Reserve officials Lorie Logan and Philip Jefferson hinted at a possible stabilization of interest rates on Monday, following the surge in long-term rates. This suggestion comes as the yield on the 10-year U.S. Treasury note has soared to a 16-year high of approximately 4.8%, pushing up borrowing costs across the board.

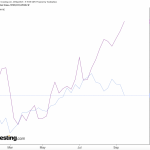

These heightened borrowing costs have been reflected in the national average 30-year mortgage rate, which has reached a 23-year high of 7.5%. Corporate bond yields have also seen an escalation, impacting business borrowing costs. These developments were discussed by both officials at a meeting of the National Association for Business Economics (NABE).

Logan, who is the president of the Federal Reserve Bank of Dallas, proposed that if these long-term rates remain high, there might be less need to raise the Fed’s benchmark rate. Jefferson, vice chair of the Fed’s board and an ally of Chair Jerome Powell, concurred with this viewpoint.

The Federal Reserve has been combating severe inflation by increasing its short-term rate from near zero to roughly 5.4% through 11 hikes since last year. This aggressive approach has sparked concerns about a potential recession.

Addressing NABE, Jefferson committed to considering these higher bond rates while assessing future policy decisions. Logan also emphasized that higher long-term bond rates could aid in achieving the central bank’s inflation target of 2%.

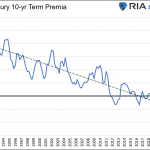

The yield on the U.S. Treasury’s 10-year note has been on a steady rise since July, hitting a peak not seen in over a decade and a half. This increase has inflated various borrowing costs, including that of mortgages and corporate bonds.

In conclusion, the surge in long-term yields might influence future Federal Reserve policy decisions, potentially leading to stable interest rates if these high yields persist.