BlackRock anticipates further U.S. bond market turbulence amid inflation and debt crisis fears

Investment experts at BlackRock (NYSE:BLK) reported a significant sell-off in the US bond market, marking an acceleration in bond yield increases due to persistent inflation, steep interest rate hikes, and fears of a sovereign debt crisis. The Federal Reserve’s strategy to maintain high rates for an extended period in an attempt to control inflation has contributed to this yield surge.

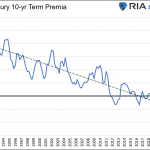

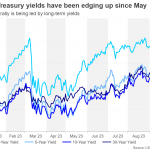

The iShares’ 20+ Year Treasury ETF has suffered a substantial drop of 46% since 2020. Meanwhile, 10-year Treasury yields have seen a significant leap to 4.72% from their previous level of 0.92%. This situation has led BlackRock to steer clear of long-term US bonds due to the expectation of further term premium and yield increases.

Several financial experts, including Bank of America strategists, billionaire investor Ray Dalio, and ING strategists, agree that this is the most severe bond bear market in US history. Dalio has warned of a “classic late, big-cycle debt crisis,” while ING strategists predict that 10-year Treasury yields could reach mid-2007 levels of 5%.

The annual inflation rate has climbed to 3.7%, further intensifying the financial landscape. Over the past decade, US government debt has doubled, reaching a record-breaking $33 trillion.

Despite these challenging conditions, BlackRock shows preference for short-dated US bonds like two-year Treasuries. These bonds offer high yields with relatively lower risk compared to their long-term counterparts. This perspective aligns with economist Nouriel Roubini’s concerns about the current financial situation.