1 Stock to Buy, 1 Stock to Sell This Week: JPMorgan Chase, Citigroup

- CPI inflation, Fed FOMC minutes, start of Q3 earnings season in focus.

- JPMorgan Chase shares are a buy with upbeat earnings on deck.

- Citigroup’s stock will struggle amid weak profit outlook.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

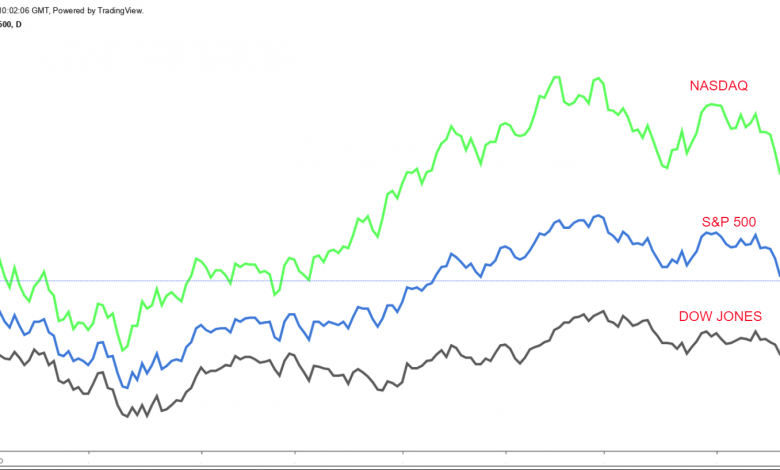

U.S. stocks rallied on Friday, with the S&P 500 and Nasdaq registering their biggest daily percentage gains since late August as investors digested a U.S. jobs report that showed hiring rose broadly in September while wage growth slowed.

For the week, the benchmark S&P 500 and technology-heavy Nasdaq Composite rose 0.5% and 1.6% respectively, to snap a four-week losing streak. The blue-chip Dow Jones Industrial Average lagged, falling 0.3%.

S&P 500 vs. Nasdaq vs. Dow

S&P 500 vs. Nasdaq vs. Dow

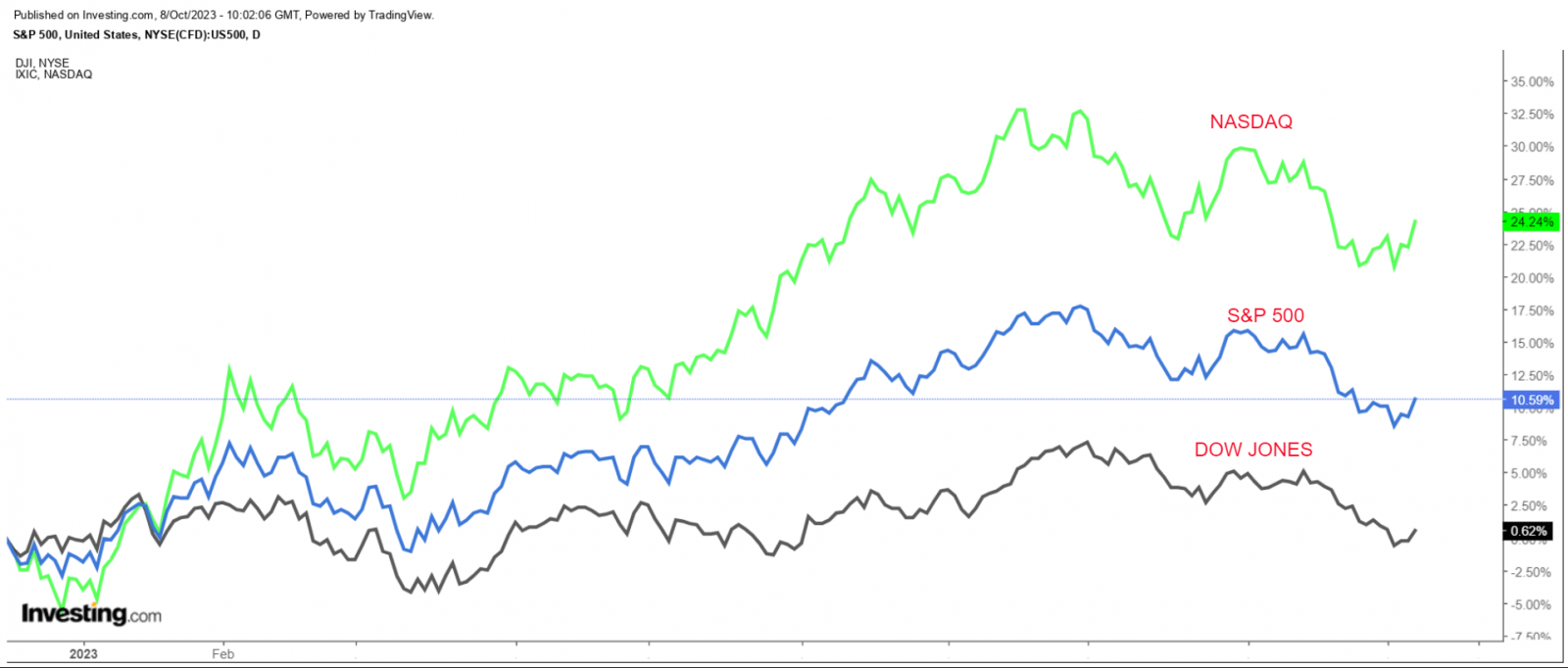

The week ahead is expected to be another eventful one as investors continue to gauge the outlook for inflation, interest rates, and the economy.

On the economic calendar, most important will be Thursday’s U.S. consumer price inflation report for September, which is forecast to show headline annual CPI cooling to 3.6% from the 3.7% increase seen in August.

Investing.com Economic Calendar

Investing.com Economic Calendar

The CPI data will be accompanied by the release of the minutes of the Federal Reserve’s last meeting in September, which will surely add to the debate on the U.S. central bank’s next move.

As of Sunday morning, financial markets see a 73% chance of the Fed holding rates at current levels at its November meeting, according to Investing.com’s Fed Rate Monitor Tool, and a 27% chance of a quarter-percentage point rate hike.

Meanwhile, the earnings season officially kicks off on Friday with JPMorgan Chase, Wells Fargo (NYSE:WFC), Citigroup, BlackRock (NYSE:BLK), Delta Air Lines (NYSE:DAL), PepsiCo (NASDAQ:PEP), UnitedHealth Group (NYSE:UNH), and Walgreens Boots Alliance (NASDAQ:WBA) all scheduled to release quarterly results.

Regardless of which direction the market goes next week, below I highlight one stock likely to be in demand and another that could see fresh downside.

Remember though, my timeframe is for the week ahead, Monday, October 9 – Friday, October 13.

Stock To Buy: JPMorgan Chase

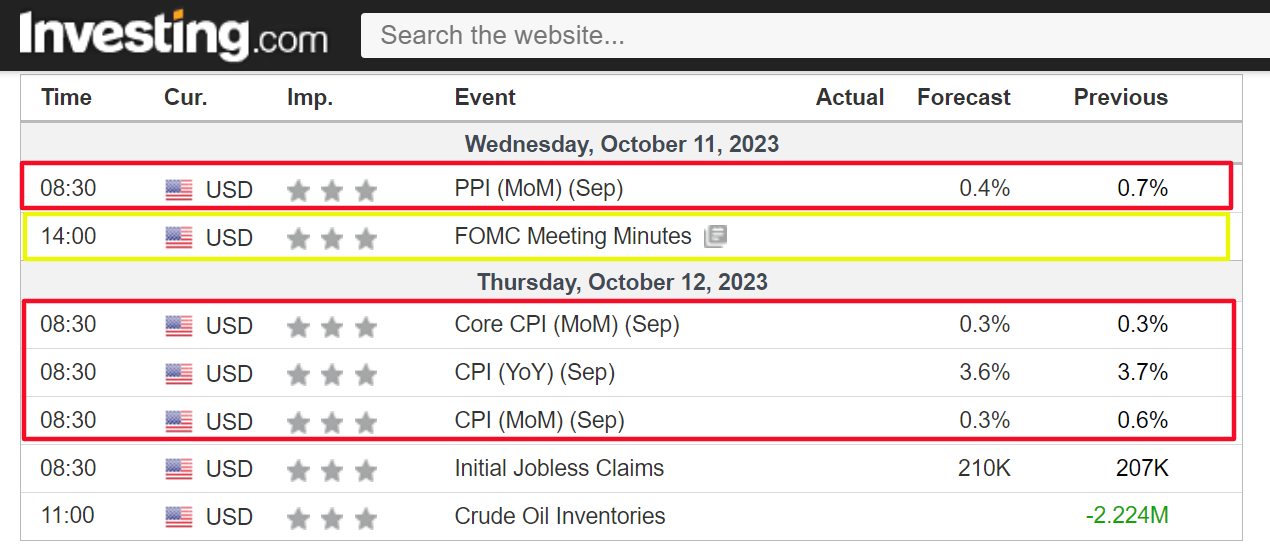

I believe shares of JPMorgan Chase (NYSE:JPM) will outperform in the coming week as the financial services giant’s third quarter earnings will surprise to the upside, in my view, thanks to a strong performance across its key business segments.

JPMorgan is scheduled to deliver its latest financial results ahead of the opening bell on Friday, October 13 at 6:50AM EST, with both analysts and investors growing increasingly bullish on the banking powerhouse’s prospects.

Profit estimates have been revised upward 10 times in the last 90 days, according to an InvestingPro survey, compared to zero downward revisions.

JPMorgan Chase Earnings Forecast

JPMorgan Chase Earnings Forecast

Consensus expectations call for earnings per share of $3.87, up 24% year-over-year. Meanwhile, revenue is anticipated to jump 20% from last year to $39.3 billion, reflecting solid growth in its retail banking division.

In addition, I expect fixed income trading revenue, equity trading revenue, and investment banking revenue to all top estimates as it benefits from higher interest rates, market volatility, and a stronger IPO market.

Market participants expect a sizable swing in JPM shares following the print, as per the options market, with a possible implied move of roughly 5% in either direction. Shares rallied 3% after its last earnings report in July.

Despite a challenging environment for financials, the Jamie Dimon-led bank has beaten Wall Street’s top and bottom-line estimates for four straight quarters, highlighting the strength of its business and strong execution across the company.

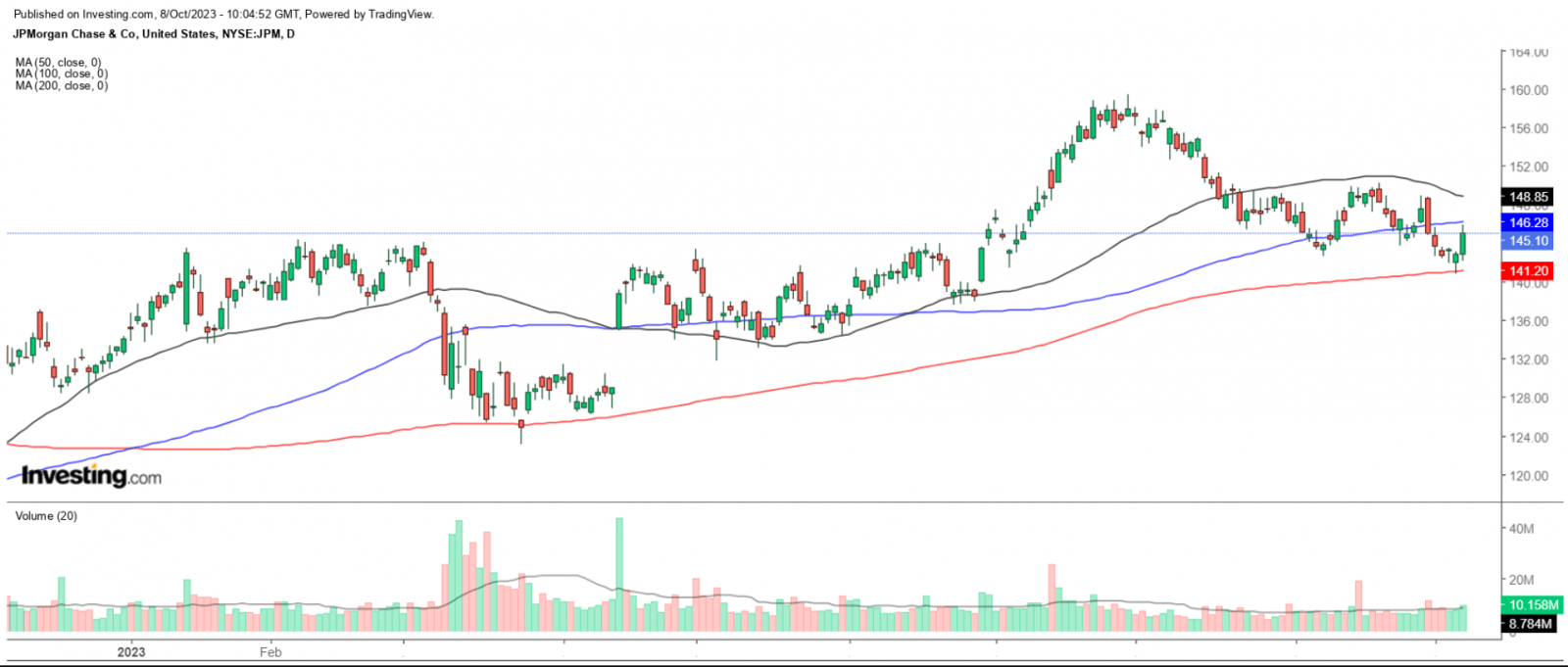

JPMorgan Chase Chart

JPMorgan Chase Chart

JPM stock closed Friday’s session at $145.10 after falling to a more than three-month low of $140.83 a day earlier. At current levels, the New York-based lender has a market cap of roughly $422 billion, earning JPM the status of the most valuable bank in the world.

Year-to-date, JPM shares are up +8.2%, significantly outperforming industry peers such as Bank of America (-21.3%), Wells Fargo (-3.9%), Morgan Stanley (-5.5%), Goldman Sachs (-9%), and Citigroup (-10.3%).

It should be noted that JPM remains undervalued according to the quantitative models in InvestingPro, and could see an increase of about 6% from Friday’s closing price to its ‘Fair Value’ target of roughly $153.

Stock To Sell: Citigroup

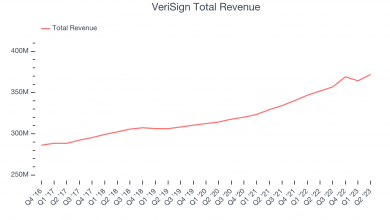

Staying in the financial sector, I expect Citigroup (NYSE:C) stock will suffer a losing week as the megabank’s latest earnings report will likely reveal another sharp slowdown in profit growth due to the difficult economic environment.

Citi’s financial results for the third quarter are due ahead of the opening bell on Friday, October 13 at 8:00AM EST and are once again likely to take a hit from a slowdown in its consumer banking business.

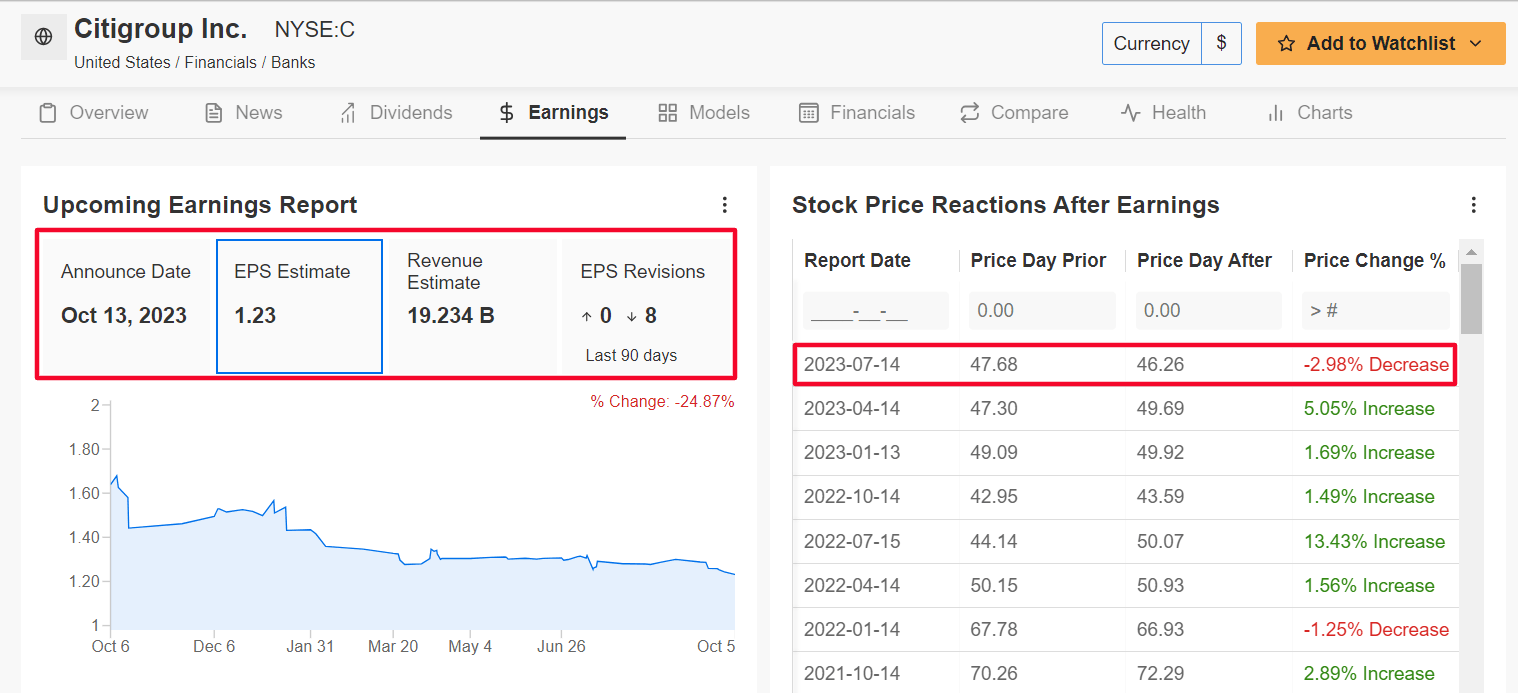

Options trading implies a roughly 6% swing for C shares after the update drops. Shares slumped 3% after the company’s last earnings print in mid-July.

Underscoring several headwinds Citigroup faces amid the current backdrop, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the report, with analysts cutting their EPS estimates eight times in the last 90 days, compared to zero upward revisions. Citigroup Earnings Forecast

Citigroup Earnings Forecast

Wall Street sees the New York-based financial services company earning $1.23 a share, declining 24.5% from EPS of $1.63 in the year-ago period.

Revenue expectations are equally concerning, with sales growth forecast to rise just 3.9% year-over-year to $19.23 billion due to an ongoing slowdown in its consumer banking unit.

Beyond the top-and-bottom line figures, comments from CEO Jane Fraser should offer further guidance on how she expects the bank to perform throughout the rest of the year amid lingering macroeconomic headwinds and worries over deposit stability.

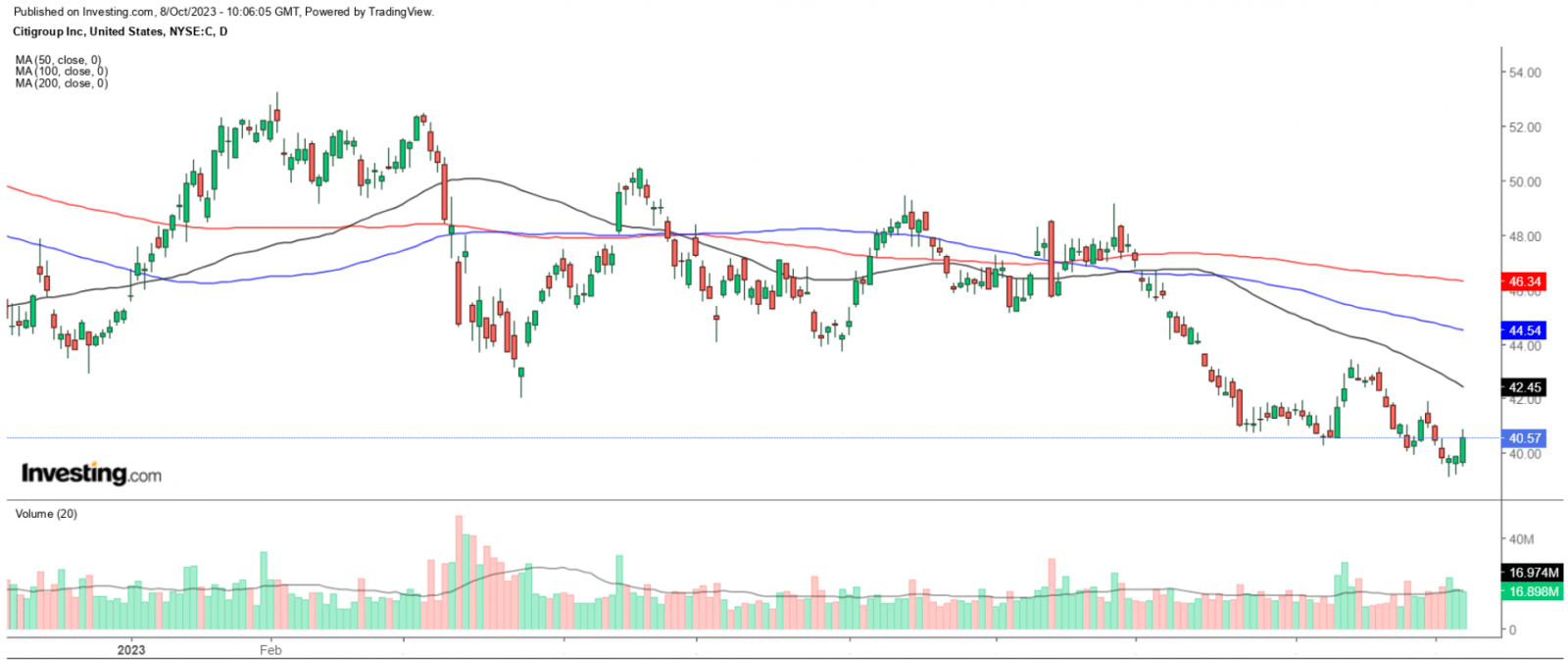

Citigroup Chart

Citigroup Chart

C stock ended Friday’s session at $40.57. Shares slumped to a 52-week low of $39.14 on Wednesday, which was the lowest level since May 2020. At its current valuation of $78 billion, Citigroup is the fourth-largest banking institution in the United States, behind JPMorgan Chase, Bank of America, and Wells Fargo.

Citigroup shares have underperformed those of the other big banks this year, falling 10.3% in 2023, amid lingering worries over the health of the financial sector in the aftermath of the regional banking crisis.

It is worth mentioning that Citi currently has a below average InvestingPro ‘Financial Health’ score of 1.98/5.00 due to concerns on profitability, growth, and free cash flow.

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.