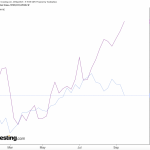

US job market signals mixed, causing dollar volatility and impacting Fed’s interest rate decision

© Shutterstock

The US Nonfarm Payrolls (NFP) data for September, expected to indicate a 170K job increase and an unemployment rate of 3.7%, could potentially cause volatility in the US dollar. The Average Hourly Earnings data is also expected to play a crucial role in shaping market behavior.

Evidence of labor market tightness was seen in August when job openings surged to 9.610 million, bolstering expectations for an interest rate hike. However, these expectations have been tempered by weak labor market indicators.

The odds for a November Federal Reserve (Fed) rate hike have dropped following the release of the ADP report which showed only 89,000 new private sector jobs in September, coupled with a slight fall in the ISM Services PMI. These elements are expected to significantly impact the Fed’s decision on interest rates.

The NFP data release could also affect the EUR/USD pair, as stated by TD Securities analysts.