Hut 8 Adds 111 Bitcoin to Reserves, Shareholders Back Merger With USBTC

Canadian Bitcoin mining firm Hut 8 has continued to accumulate Bitcoin, adding 111 BTC to its reserves in September 2023. This brings the company’s total reserves to over 9,366 BTC, which includes 7,269 unencumbered BTC. The company’s hodl strategy remains unchanged, as evidenced by its statement that “No Bitcoin was sold during the month”. This is despite a significant drop in mining pace over the year, with September’s output far less than the peak output of 147 BTC in May 2023 and the September 2022 output of 277 BTC.

The company’s reserves have been steadily increasing since September 2022 when it had about 8,000 BTC, distinguishing Hut 8 from other publicly traded firms such as Core Scientific and Riot Blockchain (NASDAQ:RIOT) that have sold part of their holdings due to market pressures.

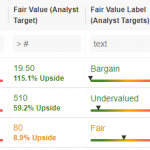

According to InvestingPro data, Hut 8 has a market cap of 443.38M USD and a negative P/E ratio of -4.82. The company’s revenue for the second quarter of 2023 was 69.23M USD, showing a decline of 55.36% compared to the same period last year. This aligns with the InvestingPro Tip that Hut 8 has been experiencing a decline in revenue at an accelerating rate. The company’s stock price has also seen significant movement, with a 1-week total return of 8.99% but a 3-month total return of -49.24% as of the end of 2023.

In addition to its accumulation strategy, Hut 8 is also in the process of a merger with industrial cryptocurrency miner US Bitcoin (USBTC). The merger was announced in February 2023 and has received approval from the Supreme Court of British Columbia. Upon completion, the merger will result in a new entity known as “New Hut”, as stated by CEO Jaime Leverton.

The proposed merger has garnered significant support from Hut 8’s shareholders. They demonstrated their approval by voting overwhelmingly in favor of the deal, which is expected to bring highly diversified fiat revenue streams to the new entity. This move aligns with Hut 8’s long-term vision to establish diversified revenue streams within the crypto industry.

InvestingPro Tips suggests that Hut 8, despite its significant return over the last week, suffers from weak gross profit margins and volatile stock price movements. Analysts do not anticipate the company will be profitable this year, which is reflected in its negative P/E ratio. For more insights like these, consider checking out InvestingPro, which offers a wealth of additional tips on various companies.