U.S. 10-year yields leap as bond market anticipates end of rate hikes

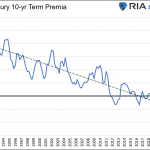

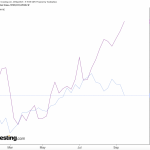

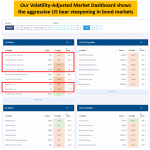

In a significant development this Thursday, the long-end of the bond market is seemingly concluding its final round of rate hikes, resulting in a notable jump in US 10-year yields from 4.00% to 4.72%. This shift underscores the market’s focus on short-term rates and the potential implications for the Federal Reserve’s monetary policy.

The movement in the bond market suggests a decreasing likelihood of further intervention by the Federal Reserve. Observers have noted that rising long-term rates could reduce the need for the central bank to step in, as it often does when attempting to control inflation or stabilize economic activity.

Futures markets are also reflecting these expectations, with indications of a reduced probability of an interest rate hike. Specifically, chances of a 22% rate hike in November have diminished, and the likelihood of any increase reaching 37% this year appears less likely.

These trends in the bond market also suggest potential upcoming rate cuts. While this is still speculative, it points to an evolving landscape where both investors and policymakers must remain vigilant and responsive to changes. These developments highlight the interconnectedness of financial markets and monetary policy, and their collective impact on broader economic conditions.