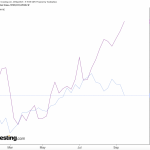

Gulf Stock Markets Advance Amid Easing US Rate Concerns

Gulf stock markets saw an advancement on Tuesday, driven by easing concerns about US interest rates. Federal Reserve officials indicated that rising US Treasury yields might deter further rate hikes, impacting the Gulf Cooperation Council’s (GCC) monetary policy due to regional currencies’ link to the US dollar.

Saudi Arabia’s index ended its eight-day losing streak, rising by 0.6%. This upward movement was significantly contributed to by Saudi Aramco (TADAWUL:2222), Riyad Bank, and Elm Company. The Qatari index also observed a 0.2% increase, with Industries Qatar and QNB playing a substantial role in this rise.

Dubai’s index managed to recover from a previous day’s 2.6% drop despite a fall in Emirates NBD. This recovery was largely due to gains in Emaar Properties and Tecom Group. However, the Abu Dhabi index fell for the fifth consecutive day, with First Abu Dhabi Bank dropping 1.5%.

Meanwhile, Egypt’s blue-chip index experienced positive movements amidst investors’ monitoring of the Israel-Hamas conflict. The index saw surges in Misr Fertilizers Production and Eastern Co., contributing to its overall performance.

The recent developments in Gulf stock markets highlight the influence of US monetary policy on regional economies, especially those with currencies pegged to the US dollar. The easing of US rate concerns has provided some relief for these markets, leading to advancements in several indices across the region.