Fed Vice Chair expresses concern over rising Treasury yields

Federal Reserve Vice Chair Philip Jefferson has voiced concerns over the escalating Treasury yields, describing them as an additional economic burden. In his keynote address to the National Association for Business Economics conference in Dallas on Monday, Jefferson emphasized the importance of considering the rising yields on long-dated U.S. bonds in policymakers’ deliberations about further tightening monetary policy.

Jefferson provided insights into his understanding of bond market dynamics and their impact on tightening financial conditions, which he said would guide his decisions on future policy trajectories. He also affirmed the officials’ readiness to evaluate further required policy fortification.

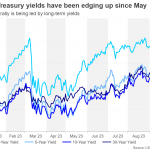

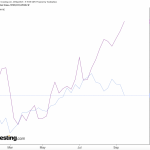

Over the past 18 months, there has been a more than five-percentage point increase in the federal funds rate. Following their meeting in September, a majority of U.S. central bankers forecasted a quarter-point increase by the end of 2023. Since this meeting, there’s been a 40 basis points surge in 10-year note yields.

Other Fed officials, such as Mary Daly of San Francisco and Lorie Logan of Dallas, have suggested that recent financial tightening could replace additional rate hikes. Jefferson stressed maintaining a risk management balance between insufficient policy tightening and excessive restrictiveness.