ECB officials signal potential end to monetary tightening

© Shutterstock

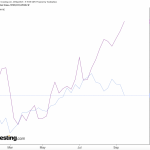

European Central Bank (ECB) officials have indicated that the era of monetary tightening may be coming to an end, with key figures projecting a stabilization of consumer-price gains by 2025. The projections come amidst ongoing discussions and varied opinions within the ECB about the future direction of monetary policy.

François Villeroy de Galhau, a member of the ECB Governing Council and the Bank of France Chief, expressed optimism that monetary tightening has run its course. He anticipates consumer-price gains to normalize at 2% by 2025 in both the euro area and France.

This sentiment was echoed by Slovak central bank Governor Peter Kažimír, who suggested that the rate hike implemented in their last meeting could possibly be the final one. However, this is contingent on forecasts scheduled for December and March.

Despite these indications, not all ECB officials are in agreement. Luis de Guindos, Vice President of the ECB, warned against initiating discussions on early rate cuts. He emphasized the importance of their 2% price stability target, suggesting a cautious approach towards any potential policy shifts.

Similarly, Bundesbank President Joachim Nagel advocated for the continuation of a restrictive policy stance due to concerns over high core inflation. This underscores the ongoing debate within the ECB about the appropriate balance between supporting economic recovery and managing inflation risks.

As these discussions continue, market observers will be closely watching for any changes in policy direction that could impact economic conditions across Europe.