Bitcoin Miners Gear Up for 2024 Halving Amid Regulatory Changes

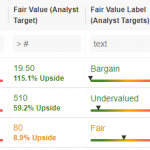

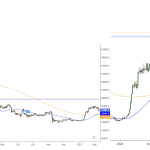

As the 2024 Bitcoin halving draws near, cryptocurrency miners are investing in advanced equipment to enhance their chances of earning the diminishing BTC rewards. This move comes despite an increase in block-solving difficulty and energy consumption. The bear market of 2022-23 pushed some miners towards bankruptcy or diversification, while larger entities like Riot Platforms and Marathon Digital (NASDAQ:MARA) weathered the storm through capital accumulation and efficient operations.

Riot Platforms has broadened its business to incorporate equipment manufacturer ESS Metron, while Marathon Digital has secured additional equity from the Bank of New York Mellon (NYSE:BK) Corporation. Along with public miner CleanSpark, these companies are purchasing advanced ASICs from manufacturers such as Canaan and fine-tuning power-purchasing agreements (PPAs) with entities like the Energy Reliability Council of Texas (ERCOT) in preparation for the upcoming halving.

The potential approval of a Bitcoin ETF, like the one proposed by BlackRock (NYSE:BLK), could bolster institutional Bitcoin demand and improve miner profitability, said Didar Bekbauov, a Texas-based mining CEO. Adam Back, CEO of Blockstream, also expects an increased demand for new mining rigs.

Regulatory changes have compelled miners like Greenidge Generation Holdings and BTC.kz to adapt. Some are exploring alternative revenue streams such as Artificial Intelligence (AI) data centers. This shift demonstrates the ongoing resilience and adaptability of mining companies despite the challenging market conditions and impending halving event.